Trade Date Netting

C7 SCS

Trade Date Netting (TDN) is the netting model C7 SCS applies for all transactions involving CCP-eligible instruments concluded at the Frankfurt Stock Exchange (MICs: XETR and XFRA) and for all physical deliveries out of at Eurex Deutschland (MIC: XEUR) that result in securities transactions settling at Clearstream Europe or SIX SIS.

In order to meet different preferences on how single trades should be processed within a Net Processing Unit (NPU) on the trade date, we offer three different Net Processing methods: Netting, Aggregation and Gross.

Clearing Members will have the choice in C7 SCS to define Net Processing method on level: settlement account × trading location × trading member x account type.

Name | Description |

"Netting" (default option) | All Single Trades within one NPU are netted to one Net Position Trade in the standard case. Strange Nets may occur. |

"Aggregation" | All Single Buy Trades within one NPU are aggregated to one Net Position Trade, all Single Sell Trades are aggregated to one separate Net Position Trade. |

"Gross" | Each Single Trade is transferred one-to-one into one Net Position Trade. |

Netting

If a Clearing Member chooses to perform Netting as a Net Processing method, single trades belonging to the same NPU are netted to form one Net Position Trade with a net quantity and a net cash amount.

Strange Net Handling

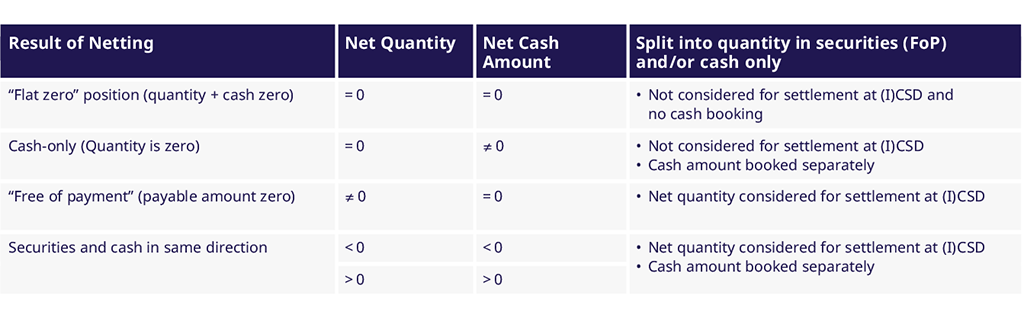

Clearing Members can choose between StrangeNet Methods to determine how non-standard results from Netting are handled:

- UNWIND: The netting result is unwound. Buy and sell trades are aggregated separately. Two Net Position Trades are generated on either side.

- NET/SPLIT: The netting result is kept. Net Position Trades and delivery instructions are generated as outlined in below table.

Aggregation

If the Clearing Member chooses Aggregation, the sell and buy obligations will be separately aggregated and two Net Position Trades with two separate delivery instructions,) are created on either side.

Linking before Aggregation

Clearing Members who chose the Net Processing method 'Aggregation' have the possibility to influence the Net Processing results by linking single trades concluded at FWB before aggregation by sending SWIFT messages MT543 to C7 SCS.

Gross

In case Clearing Member’s choice is 'Gross', no netting is performed and one Net Position Trade (with one delivery instruction) is created for each single trade. Each trade receives a separate Net Position Trade ID.