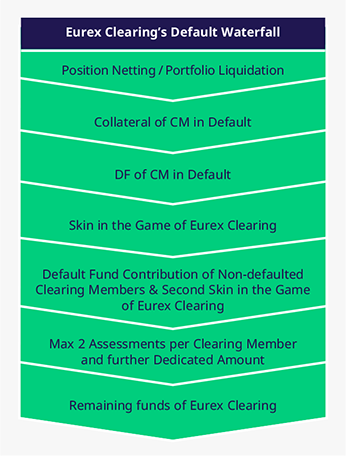

Default Waterfall

In case of the default of a Clearing Member and the occurrence of a termination event with respect to such Clearing Member, Eurex Clearing primarily uses the financial resources provided by such defaulted Clearing Member (its margin collateral and its contribution to the Default Fund) to cover resulting losses.

If the defaulted Clearing Member's resources are insufficient to cover all losses, Eurex Clearing’s own contribution to the Default Waterfall, the so-called "Dedicated Amount" or "Skin in the Game" (SITG), is applied.

If the SITG is insufficient to cover all remaining losses, non-defaulted Clearing Members' contributions to the Default Fund and "Second Skin in the Game" of Eurex Clearing (SSITG) are utilized.

If the pre-funded contributions to the Default Fund and SSITG are insufficient to cover all remaining losses, Clearing Members are required to provide Eurex Clearing with additional financial resources, the so-called assessments ( also called "recovery cash calls"). Simultaneously to Clearing Members providing assessments, Eurex Clearing provides additional financial resources as well, the so-called Further Dedicated Amount.

Finally, Eurex Clearing's equity capital is applied to cover any remaining losses. In addition, Deutsche Börse AG has issued a letter of comfort in favour of Eurex Clearing, according to which Deutsche Börse AG will provide Eurex Clearing with financial funding to enable Eurex Clearing to comply with its obligations.

The standard Default Waterfall is applicable in case of the ISA Direct clearing model as well.

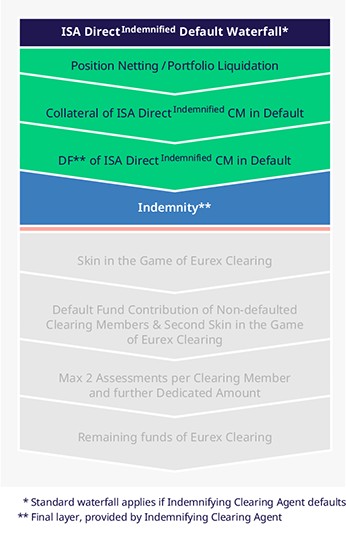

Default Waterfall by ISA Direct Indemnified Clearing Model

In case of the default of an ISA Direct Indemnified Clearing Member and the occurrence of a termination event with respect to such ISA Direct Indemnified Clearing Member, Eurex Clearing primarily uses the financial resources provided as margin collateral and as Default Fund contribution to cover resulting losses.

If the margin and default fund contribution of the defaulting ISA Direct Indemnified CM are not sufficient to cover all losses, all remaining losses will be covered by the indemnity provided by the Indemnifying Clearing Agent (ICA).

Default Fund Support

What is the Eurex Clearing Default Fund, and how is it calculated? Find more information on the Support page.