Default Management Process

We have implemented a Default Management Process (DMP) to handle the default of one or more of our Clearing Members.

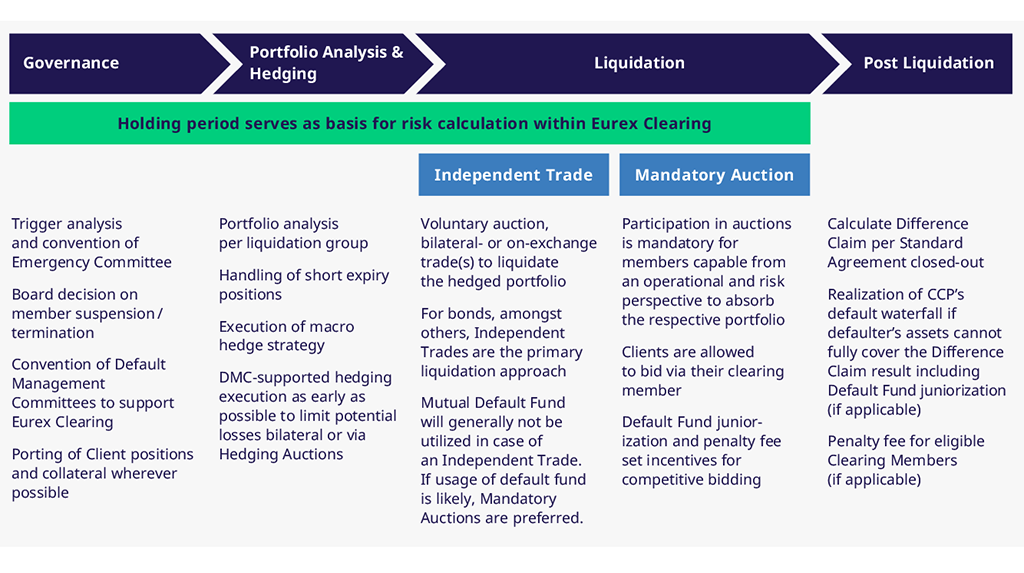

Both the DMP and the margin methodology Eurex Clearing Prisma are based on a Liquidation Group set-up. A Liquidation Group (LG) contains products with similar risk characteristics which can be liquidated simultaneously in time.

For each LG a dedicated holding period has been defined, which illustrates the time that we need to finalize the DMP for a portfolio in such LG. Identical holding periods are used as input factors for the margin calculation, to ensure that given margin offsets persist within the DMP.

Which trigger events may lead to a default

We have defined two kinds of trigger events, which may lead to the default of a Clearing Member.

- The commencement of insolvency proceedings over a Clearing Member’s estate results in an automatic termination of all transactions between Eurex Clearing and such Clearing Member and the initiation of the DMP.

- In addition, certain non-automatic termination events (including a failure to pay or to deliver margin, a failure to comply with the Clearing Conditions, or an opening of reorganization or restructuring proceedings) have been defined, upon which a default does not occur automatically, but is actively declared by Eurex Clearing.

- In case of any non-automatic termination event, Eurex Clearing may grant a grace period to remedy the respective breach or failure, before declaring a Clearing Member to be in default.

Overview of the Default Management Process

Default Management Process reflects best practice and complies with market requirements and regulatory guidelines

Goal of the DMP is to re-balance the CCP. Therefore, Eurex Clearing establishes new transactions with its Clearing Members which replace those transactions that have been terminated with the defaulted Clearing Member.

In addition, Eurex Clearing might have to sell or buy bonds, which were underlying terminated Special Repo or GC Pooling transactions, if the defaulted Clearing Member was active in the Bond Liquidation Group.

The DMP is conducted in case of the default of a Clearing Member of Eurex Clearing. In case a Clearing Member's client (Disclosed or undisclosed direct client and indirect client) defaults, the handling of such default is not the responsibility of Eurex Clearing, but the responsibility of the client’s Clearing Member.

To ensure the default of a Clearing Member has the least possible impact on financial markets, Eurex Clearing allows for client porting wherever possible. For more information about the segregation models as well as the applicable timelines and pre-requisites for client porting, please visit Client Asset Protection under EMIR.