EurexOTC Clear Releases

Overview of content

- EurexOTC Clear Release 20.0

- EurexOTC Clear Release 19.0

- EurexOTC Clear Release 18.0

- EurexOTC Clear Release 17.0

- EurexOTC Clear Release 16.0

EurexOTC Clear Release 17.0

With the EurexOTC Clear Release 17.0, Eurex Clearing introduced the following enhancements:

- Introduction of Inflation Linked Asset Swaps

- A new field “ReportTrackingNumber” for OTC trades

- Processing of Clearing Broker Take-up requests outside of Eurex Clearing service hours

- Report Changes

- API Changes

- GUI Changes

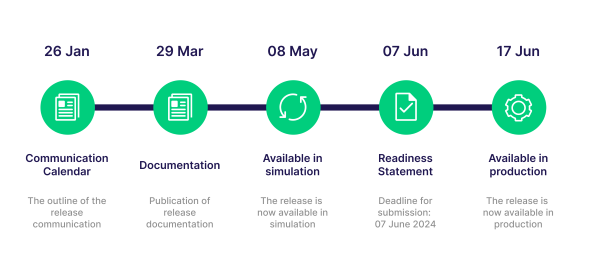

Simulation start: 08 May 2024

Production start: 17 June 2024

System Documentation

- Focus Call - Presentation

24 April 2024

The OTC system documentation are stored in the Member Section under the following path: Resources > Eurex Clearing > Documentation & Files > EurexOTC Clear > System documentation.

Circulars

Circulars

- Eurex Clearing Circular 041/24: EurexOTC Clear: Production launch announcement of EurexOTC Clear Release 17.0

- Eurex Clearing Circular 036/24 EurexOTC Clear Release 17.0: Amendments to the Clearing Conditions of Eurex Clearing AG

- Eurex Clearing Circular 006/24 EurexOTC Clear: Introduction announcement of EurexOTC Clear Release 17.0

Newsflashes

Focus Days

Cross-margining Focus Day

- 22 - 25 April 2024

- 03 - 07 June 2024

FAQ

No new columns will be added, only some fields will be filled with different values. The FpmL part will contain some additional FpML elements for SCIS.

Yes, the changes regarding the display of current notional values for Variable Interest Rate Swaps will be available in simulation environment starting from 8 May 2024. Moreover, the SCIS related GUI changes will be visible from 20th May onwards.

We cannot comment on whether or not members should perform regression tests. Nonetheless, we advise members to fully test the clearing workflow after every new release to ensure a smooth transition. Moreover, membersare recommended to test submitting the inflation-linked asset swaps via MW for clearing in order to do an end-to-end test on the product offering. If any support from Eurex's end is required for these tests, we are happy to provide support.

Readiness Statement

We kindly ask all EurexOTC Clear Members to submit the Readiness Statement for EurexOTC Clear Release 17.0 by Friday, 7 June 2024 latest.

For your convenience a online submission process has been published. The online Readiness Statement is here available: Readiness Statement. Please enter your dedicated Eurex Clearing PIN in the online questionnaire. The PIN for your company has been sent to the Central Coordinator.

Readiness Videos

Release Items/Participants Requirements

Feature/Enhancement | Details | Action Item |

Introduction of Inflation Linked Asset Swaps | The current product offering will be extended with the delivery of Inflation Linked Asset Swaps using the standard coupon inflation swap template available in MarkitWire. The product will reference the Euro HICPxt index with a maximum maturity of 50 years. Coupons can be paid periodically, i.e. monthly, quarterly, semi-annually, or annually. This product will be available in the simulation environment as of 20-05-2024. | For more information reg. the product, please reach out to your respective Sales contact. |

A new field “ReportTrackingNumber” for OTC trades | A new field 'ReportTrackingNumber' will be introduced for OTC trades which will be optionally provided by the Approved Trade Source, and if provided, Eurex Clearing will include the field information in the Trade Notification messages. | Clearing Members should evaluate the impact of consuming new trade notification messages on their side. |

Processing of Clearing Broker Take-up requests outside of Eurex Clearing service hours | The processing of TakeUpGranted and TakeupRefused messages, even if sent outside of Eurex Clearing service hours, will be possible with the introduction of the OTC Clear Release 17.0. | There is no action required. |

Report Changes | The following report changes will be made:

| We kindly ask all Clearing Members to ensure that the relevant report changes are reflected in their internal processes. |

API Changes | The following enhancements will be implemented in API modules:

| We kindly ask all Clearing Members to ensure that relevant API changes are reflected in their internal processes. |

GUI Changes | The following enhancements will be implemented in MC GUI:

The following enhancements will be implemented in OTC GUI:

| There is no action required for GUI changes. |

CRE

The CRE is Eurex Group’s central solution for reports. The CRE allows a greater flexibility and meets the needs of today’s high frequency.

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Further information about EurexOTC Clear can be found here.

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET