Oct 01, 2025

Eurex Clearing

Introduction of a new Supplementary Margin Category - margin concentration add-on for OTC IRS Portfolios

1. Introduction

Eurex Clearing AG (Eurex Clearing) herewith introduces a new Supplementary Margin Category with respect to large OTC IRS Portfolios. The new Supplementary Margin Category is a size-dependent margin concentration add-on for OTC IRS Portfolios on account level which aims at increasing the available margin for large exposures in order to balance the margin requirement and default fund contribution requirement.

The margin concentration add-on for OTC IRS Portfolios shall become effective as of 4 November 2025 and will be booked as Supplementary Margin under the Margin Class “SUMMC”. It will be charged automatically as part of the end-of-day processing whenever the relevant OTC IRS Portfolio on a specific transaction account exceeds a specific threshold (initially set to 200 million EUR).

2. Required action

With this circular, Eurex Clearing provides detailed information on the new Supplementary Margin Category including the calculation methodology. Affected Clearing Members are requested to be prepared to meet the new Supplementary Margin requirement as of 4 November 2025.

3. Details of the initiative

Eurex Clearing herewith introduces a new Supplementary Margin Category with respect to large OTC IRS Portfolios. The new Supplementary Margin Category is a margin concentration add-on for OTC IRS Portfolios on account level which increases the available margin for large exposures and has the purpose of balancing the margin requirement and default fund contribution requirement.

Calculation

The margin concentration add-on for OTC IRS Portfolios will be charged as Supplementary Margin as part of the automatic end-of-day processing of margin requirements on risk account level. It will apply for all OTC IRS risk accounts having a market risk initial margin above a minimum threshold, initially set to 200 million EUR. The size of the margin add-on will be calculated based on the Market Risk Initial Margin component (MRIM) and the margin component for the additional cost of liquidating the portfolio (Liquidity Adjustment):

𝒎𝒂𝒙[ 𝑴𝑹𝑰𝑴∗𝑴𝒖𝒍𝒕𝒊𝒑𝒍𝒊𝒆𝒓(𝑴𝑹𝑰𝑴) −𝜸∗𝑳𝒊𝒒𝒖𝒊𝒅𝒊𝒕𝒚 𝑨𝒅𝒋𝒖𝒔𝒕𝒎𝒆𝒏𝒕, 𝟎]

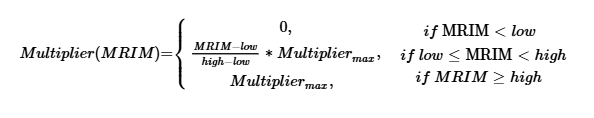

The size dependence is achieved by parametrizing the multiplier through linear interpolation between the low and high MRIM thresholds, ensuring that:

Parameter values of the margin concentration add-on for OTC IRS Portfolios

With respect to the effective date, the initial parameters of the above formula will be set as in the following table. They will be subject to a regular review and will be amended when deemed necessary. Any changes to the parameter values of the margin concentration add-on for OTC IRS Portfolios will be announced via a separate Eurex Clearing Circular.

Parameter | Value |

| Multipliermax | 0.8 |

Low MRIM Threshold | EUR 200 mn |

High MRIM Threshold | EUR 1.0 bn |

Parameter gamma (y) | 1 |

Supplementary Margin process

The margin concentration add-on for OTC IRS will be booked as Supplementary Margin under the Margin Class “SUMMC” and will be charged automatically as part of the end-of-day processing on the respective risk account.

Users who wish to simulate margin requirements including the margin concentration add-on for OTC IRS will be able to do so by using the Cloud Prisma Margin Estimator (Cloud PME) starting from 10 November 2025. We note that this functionality will not be offered in the Prisma Margin Calculator GUI and API.

Reporting

Clearing Members can find the Supplementary Margin bookings in the CC750 Daily Margin Report, which shows Margin on “Margin Class- / Liquidation Group” level. A detailed description of the report fields can be found in the Prisma Report Refence Manual in the Member Section of Deutsche Börse Group.

Additional information

Supplementary Margin is regulated under Chapter I Part 1 Number 3.5 of the Clearing Conditions of Eurex Clearing AG, or Chapter I Number 3.1.4 of the FCM Regulations of Eurex Clearing AG. The documents are available on the Eurex Clearing website under the following paths:

Rules & Regs > Eurex Clearing Rules & Regulations > 1. Clearing Conditions

Rules & Regs > Eurex Clearing Rules & Regulations > 2. FCM Regulations and FCM Default Rules

Please do not hesitate to contact the Risk Department under risk@eurex.com in case you have any questions or require further information.

Unless the context requires otherwise, terms used and not otherwise defined in this circular shall have the meaning ascribed to them in the Clearing Conditions or FCM Clearing Conditions of Eurex Clearing AG, as applicable.

Further information

Recipients: | All Clearing Members, ISA Direct Clearing Members, Disclosed Direct Clients of Eurex Clearing AG and vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

| Contact: | client.services@eurex.com, risk@eurex.com | |

| Web: | www.eurex.com/ec-en/ | |

| Authorized by: | Dmitrij Senko |