May 14, 2025

Eurex Clearing

Risk management: Update of Concentration and Wrong-way risk limits for additionally monitored risks

1. Introduction

Eurex Clearing herewith informs about an update to the related Eurex Clearing Circular 121/13 (“Additionally monitored risks: Credit risk, concentration risk and wrong-way risk”), Eurex Clearing Circular 131/13 (“Additionally Monitored Risks: Credit Risk, Concentration Risk and Wrong-way Risk – Clarification”), Eurex Clearing Circular 043/23 (“Update of Concentration and Wrong-way risk limits for the additionally monitored risks”) and Eurex Clearing Circular 079/24 (“Risk management: Update of concentration and wrong-way risk limits for additionally monitored risks”).

- Update of Concentration risk limits for margin collateral, default fund collateral, repo and cash market activities and “Same Country” Wrong-way risk limits.

Effective date: 19 May 2025

2. Required action

We kindly ask you to forward this circular to all involved departments within your company.

3. Details of the initiative

In this circular, Eurex Clearing informs the Clearing Members about updated Concentration and “Same Country” Wrong-way risk limits. All thresholds are set per Clearing Member entity.

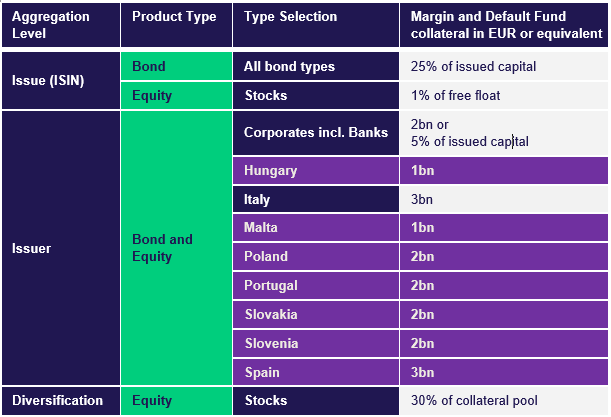

Concentration risk limits for margin and Default Fund collateral are shown in the following Table. The updated Concentration risk limits are highlighted in purple.

The complete set of updated Concentration and Wrong-way risk limits are available in the Member Section of Deutsche Börse Group within the following path: Resources > Eurex Clearing > Documentation & Files > Risk Parameters.

For further information on additionally monitored risks, please refer to the Eurex Clearing website www.eurex.com/ec-en under the following link:

Services > Risk management > Credit, concentration & wrong way risk

Unless the context requires otherwise, terms used and not otherwise defined in this circular shall have the meaning ascribed to them in the Clearing Conditions or FCM Clearing Conditions of Eurex Clearing AG, as applicable.

Further information

Recipients: | All Clearing Members, ISA Direct Clearing Members, Disclosed Direct Clients of Eurex Clearing AG and vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Related circulars: | Eurex Clearing Circulars: 121/13, 131/13, 043/23, 079/24 | |

Contact: | Your Clearing Key Account Manager or client.services@eurex.com | |

Web: | www.eurex.com/ec-en/ | |

Authorized by: | Dmitrij Senko |