Sep 19, 2025

Eurex

Eurex Repo Monthly News August 2025

Market briefing: ''Strong growth in GC Pooling and the Repo Market segments in August''

by Frank Gast and Carsten Hiller, Eurex Repo

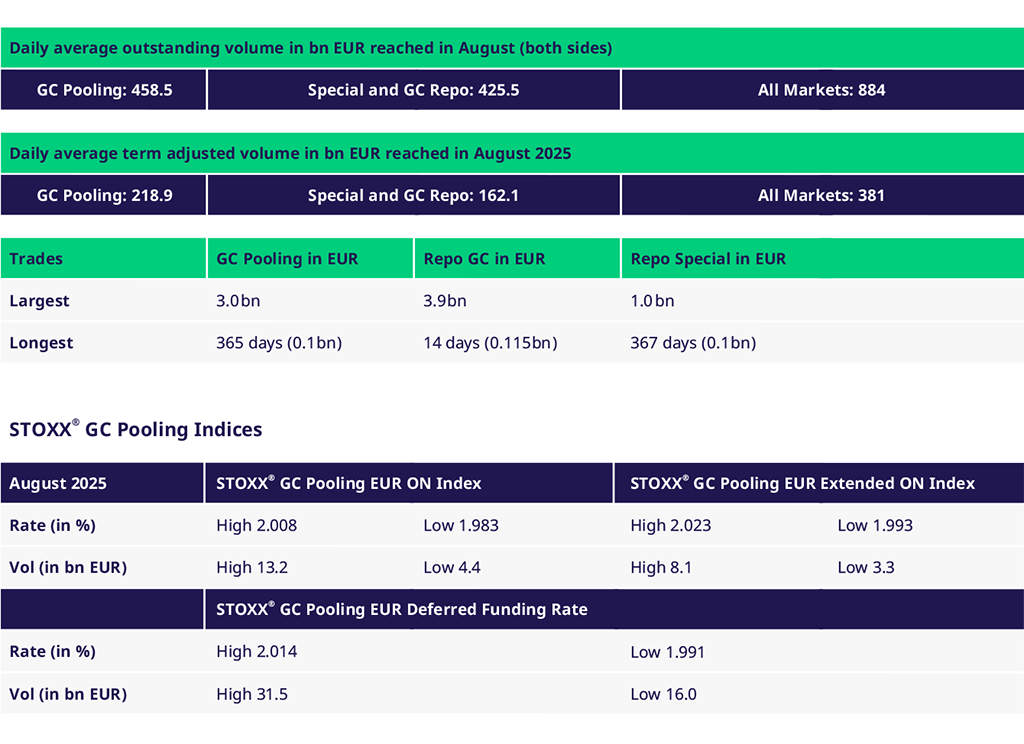

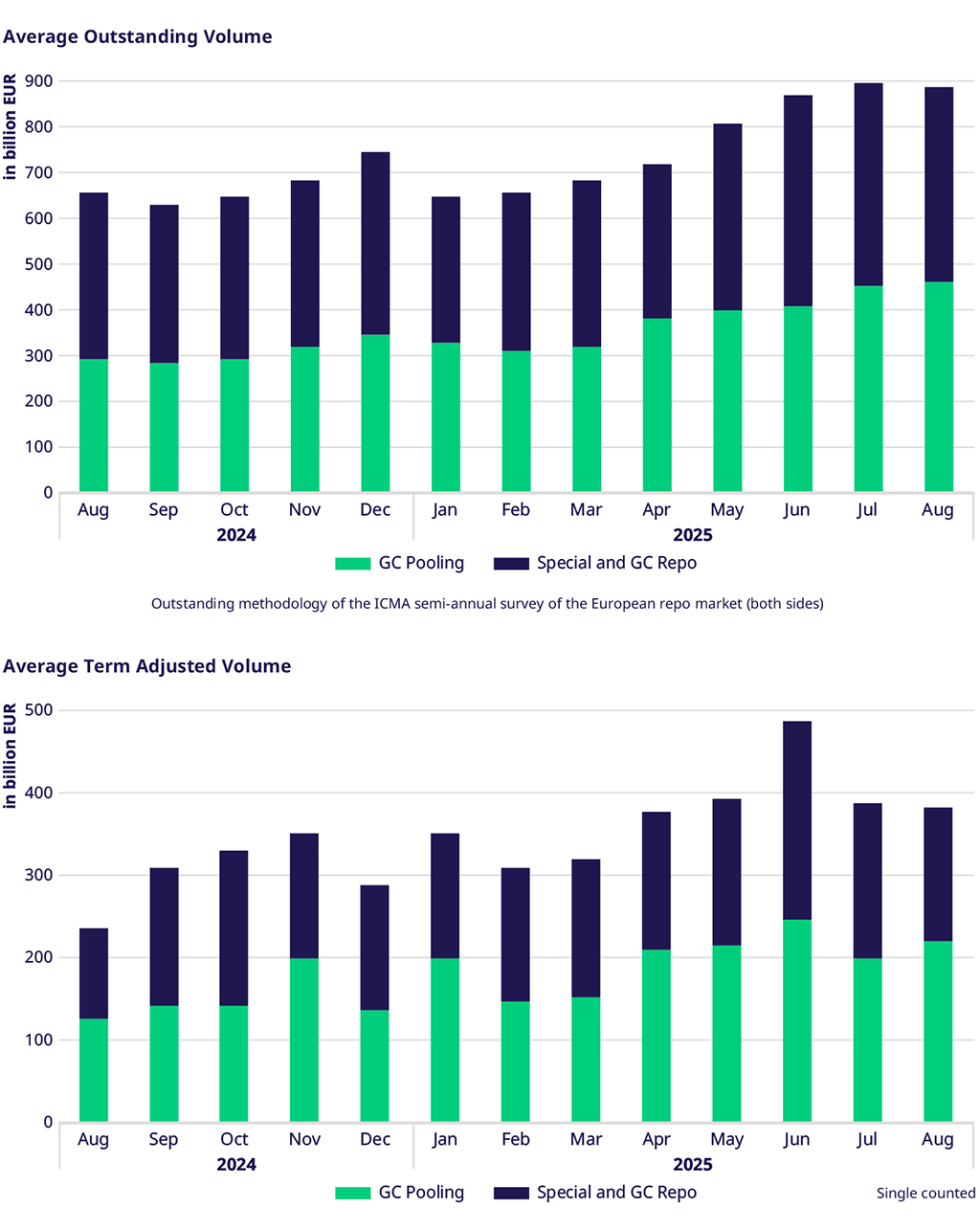

In August 2025, total term-adjusted volumes increased significantly by 63 percent compared to August of the previous year. GC Pooling volumes rose by 74 percent, while the repo market segment (GC and Special) grew by 50 percent. On a year-to-date basis, term-adjusted volumes were up by 8 percent across all market segments, mainly driven by strong development in GC Pooling, which jumped by 27 percent. In contrast, the repo market segment declined by 7 percent.

Outstanding and Traded Volumes

Outstanding volumes reached a new record high in August. The average outstanding volumes also increased year-to-date by 9 percent, with GC Pooling showing a notable jump of 22 percent, while the repo market segment remained almost flat.

Spreads and Collateral

Overnight rates over month-end were very stable and even slightly higher than some days before month-end, whereas rates usually drop by a few basis points over month-end.

On twelve-month terms, the average spread against the €STR OIS tightened slightly to 17 basis points from 18 basis points in July, while in three-month terms it widened slightly to 10.5 basis points.

GC & Specials

Compared to July, GC traded volumes dropped by 39 percent, while Specials increased by 25 percent. The decline in GC was mainly due to a shift from GC into GC Pooling, where average traded volumes also increased by 10 percent compared to July.

Furthermore, we have seen a strong increase in Specials which was driven by robust activity in EUR government bonds, particularly Bunds, France, and Spain, while volumes in Italian government bonds decreased slightly versus July.

Bunds were up by 33 percent versus July and 25 percent higher compared to August 2024.

In SSAs, there was a small drop in average traded volumes versus July by 5 percent. However, overall year-to-date volumes are still 75 percent higher than in the same period last year, mainly due to more than twice as high volumes in EU bonds compared to 2024.

GC Pooling

GC Pooling traded volumes increased by 10 percent, and average term-adjusted GC Pooling volumes also increased by 12 percent compared to July.

The strong growth was mainly driven by further expansion in the INT MXQ basket, where 37 percent was traded in one-month terms and 49 percent in two-month terms. The INT MXQ basket has reached a share of 14% of total GC Pooling volumes within a period of about 5-6 months.

Within the other baskets, the majority of volume was traded in terms up to one week, but August also saw good activity across the curve in standard terms up to twelve months and significant volumes in non-standard flex terms, mainly up to one month.

Volumes

| |||

|

Participants: 164