Readiness for projects

Overview of content

- New T7 Web GUIs

- CCS RRS Release 2.0

- RRS Release 1.7 for non-MiFIR firms

- RRS Release 1.4 for non-MiFIR firms

- RRS Release 1.3 for non-MiFIR firms

- Short Code and Algo ID Solution 2.0

- Digital Operational Resilience Act (DORA)

- Eurex Trading Participant Due Diligence Statement 2026

- ISV Registration & Software Management

- T7 Disaster Recovery Test

New T7 Web GUIs

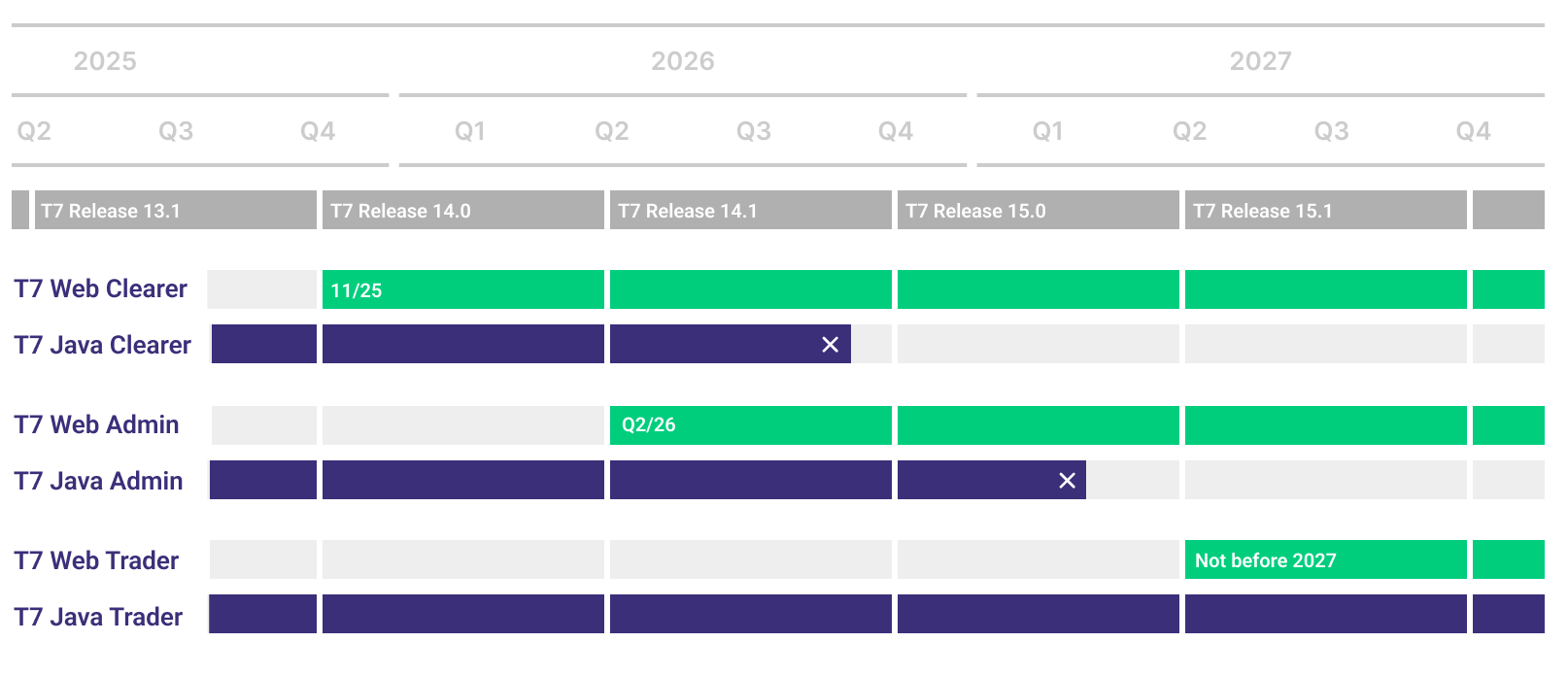

Starting in 2025, Deutsche Börse will introduce a new generation of T7 Graphical User Interfaces (GUIs) to enhance user experience and simplify maintenance. These modern T7 Web App GUIs will gradually replace the original Java-based versions.

The key change is the move to a browser-based system, which eliminates the need for Java installations, regular updates, and a dedicated launcher. This offers users a more convenient, lightweight, and state-of-the-art interface, accessible with just a web browser and a client certificate, while retaining the full functionality of the previous versions.

GUI | Introduction Web Version | End of Life Java Version |

Clearer GUI | Simulation: September 2025 Production: November 2025 | Simulation: Q2/2026 Production: Q3/2026 |

Admin GUI | Simulation: Q2/2026 Production: Q3/2026 | Simulation: Q3/2026 Production: Q4/2026 |

Trader GUI | Not before 2027 | Not before 2027 |

System Documentation

All technical documentation for the new T7 WEB GUIs may be found in the usual location under: Eurex > Support > Initiatives & Releases > T7 Rel. 14.0 > System Documentation > GUI Solutions

- Open Day 2025 – New T7 Web GUIs Presentation

Publication date: 01 Oct 2025 -

New T7 Web GUI - FAQ

Publication date: 01 Oct 2025

Circulars

Release Items/Participants Requirements

Feature/Enhancement | Details | Action Item |

Launch of a new generation of T7 graphical user interfaces (GUIs) | The new GUIs significantly reduce maintenance by providing a modern, state-of-the-art, lightweight GUI and enhance user experience & simplify maintenance. | If you currently use the Java-based T7 GUIs, please begin by testing the new browser-based T7 Web Clearer. This will allow you to get used to its look, feel, and functionality. The Admin and Trader GUIs will be released later. |

GUIs accessible via modern web browser & matching client certificate | Client certificates can be effortlessly downloaded & used immediately. | Client certificates signed by Deutsche Börse PKI can be downloaded from the Member Section. |

Stepwise roll-out approach of New T7 Web GUIs | The new web-based GUIs will be introduced in a stepwise approach starting with the

To ensure a smooth transition, each new GUI will be introduced first in the simulation environment, followed by production. The previous Java GUI and the new web-based version will run in parallel for one full release cycle. | To ensure a smooth transition to the new GUIs, we ask Trading Participants to become fully prepared before the old Java GUI is retired. This involves extensive testing, getting comfortable with the new layout, and creating a migration plan that includes setting up production access. Taking these steps is essential to prevent any interruption to your service. |

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!

Contact us

Eurex Frankfurt AG

Customer Technical Support

Service times: Monday to Friday 01:00 - 22:00 CET

Contact your Technical Account Manager via your VIP number found in the Member Section.

T +49-69-211-VIP / +49-69-211-1 08 88 (all)