Buyside key benefits

Tighter Spreads – Eurex Liquidity Providers (LPs) will not be paying any third-party RFQ platform fees for buyside flow. In addition, LPs that trade via Eurex EnLight will receive increased exchange rebates and use existing connectivity. These combined factors afford LPs the potential to quote tighter spreads.

Full STP with Real-time Eurex validations – No waiting for Broker or sales desks to confirm a deal has concluded on the exchange. Once struck on Eurex EnLight, there is no Approval Process (TES) or risk of trades failing.

Seamless Implementation – All counterparties are Eurex members using existing post-trade workflows and clearing setups. PB/FCM clients can use ORS/DMA IDs for access with no compliance or regulatory risk to the FCM. NO risk of PB/FCMs missing exchange approval windows.

Complete control with Leakage management – Namely: who is sent the RFQ, and what information they are shown, e.g., Price/Size/Side/Identity (full anonymity is available).

Speed & Safety – with electronic responders, simple strategies can be quoted in seconds. Only buyside can aggress (hit/lift quotes). No HFTs.

Agnostic access – 3rd party service providers not only offer EnLight, but also Eurex’ order book and TES, as well as access to all Eurex’s on and off-book services via a single-entry point.

Sellside key benefits

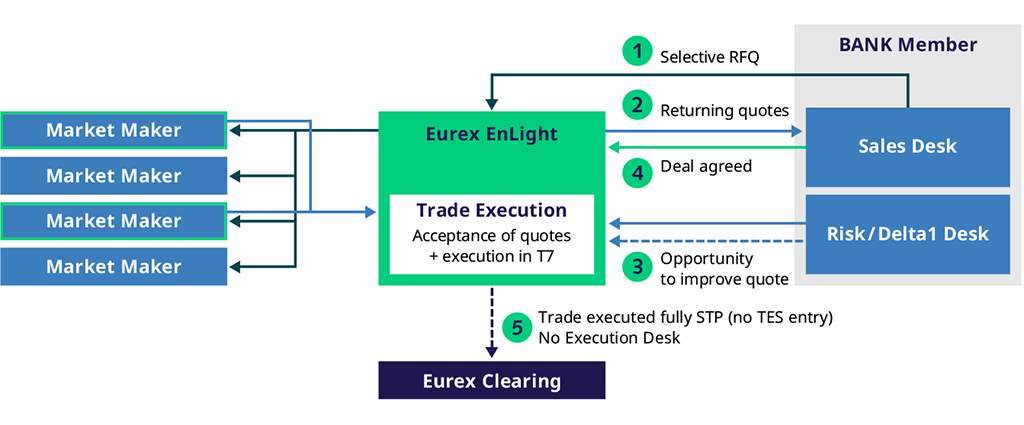

Client can use Sales as ‘One Stop Shop’ – Currently clients contact multiple PBs for prices, but with EnLight the sales desk can demonstrate RFQs and returning quotes from multiple market participants and so become a single destination for price requests by clients.

Sales controls leakage – Sales can fully control leakage for their clients, selecting where the RFQs are sent and how much information to include in those RFQs.

Trade Entry STP, so no Execution Desk involvement – Once a deal is agreed on EnLight it is sent to Eurex for immediate conclusion. Thus removing the need for additional manual trade entry by the Execution Desk.

No Approvals required, no risk of missing entry windows – EnLight is fully integrated into Eurex so there is no risk of exchange rule breaches.

Bank sales desk example workflow: