Sep 22, 2025

Eurex

Launch of a new Eurex Index Futures offering for Systematic Quantitative Index Strategies (QIS) in strategic partnership with Premialab - Société Générale and Solactive acting as Index Administrators

1. Introduction

The Management Board of Eurex Deutschland took the following decisions with effect from Monday, 27 October 2025:

- Introduction of a new offering at Eurex for Index Futures on Systematic Quantitative Index Strategies (QIS) in strategic partnership with Premialab;

- Premialab acting as third party data and analytics provider to Eurex and Eurex Clearing for all Systematic QIS indices

- Admission to trading of three index futures contracts based on Systematic QIS indices as detailed below:

o SGI Fundamental Quality European Index Futures - Index Administrator: Société Générale

o SGI Value European Index Futures - Index Administrator: Société Générale

o Solactive Make EU Great Again Index Futures - Index Administrator: Solactive AG

- Amendment of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland as outlined in Attachments 1 and 2

Production start: Monday, 27 October 2025

This circular contains all information on the trading-related updates as stated above and the updated sections of the relevant Rules and Regulations of Eurex Deutschland.

2. Required action

Participants are recommended to completely analyze the potential impact on their internal systems and procedures of the above changes.

Any Participants interested in the Systematic QIS offering, including submitting requests to launch Eurex Index futures on eligible indices, should contact Eurex (see below) for additional information.

3. Details of the initiative

A. Background and value proposition

Eurex Systematic QIS Index Futures provide a futurized listed alternative to investing via OTC swaps based on rules-based proprietary indices. QIS indices which use mathematical models combining Active and Passive investment to harvest alpha in a cost efficient and systematic manner in ways that differentiate versus the usage of other traditional index instruments.

Systematic QIS Index Futures allow market participants to gain exposure and/or hedge against identified themes, macro, traditional & alternative factors (e.g. AI, ESG, Defense, Tariffs, Cyclicals, Value, Quality) by benefiting at the same time from price transparency and full portfolio margin offsets with other Eurex equity and index derivatives.

Currently eligible Systematic QIS indices are compliant with the EU Benchmark Regulation (BMR) and are based on long only indices which include European equities as constituents from benchmark indices (e.g. STOXX Europe 600), have a minimum number of 100 constituents and a market standard weighting methodology.

Each product will have a designated Sponsor Trading Participant which will nominate themselves to act as liquidity providers in the respective new Index Futures contracts, and they will support the marketing and distribution of their respective Index Futures. The Sponsor Trading Participants will also commit to support the Index Futures for a minimum period of two years from the date of initial listing and to support with the provision of quotes in all listed expiries to facilitate the Eurex daily settlement process. As required the Sponsor Trading Participant will be connected to Premialab for data provision and licensing.

Premialab is the market leading provider of data and analytics which specializes in systematic QIS indices and multi-asset investing via an innovative data and analytics platform. Through their proprietary platform Premialab distribute index data and risk analytics to institutions globally. With this strategic partnership Eurex will receive the comprehensive data set for each of the underlying Systematic QIS index directly from Premialab, with performance and risk analytics including index levels and component data.

B. Summary of Contract Specifications

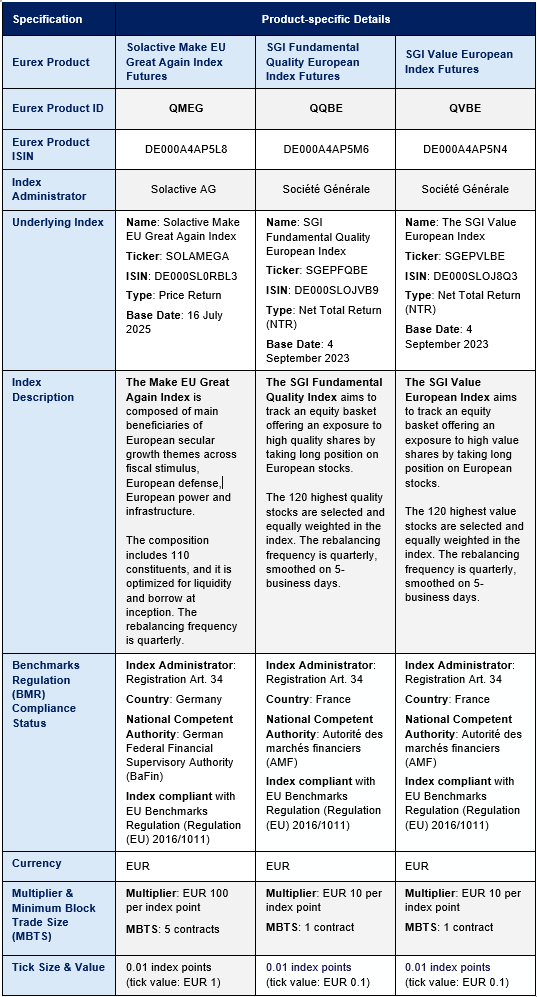

Contract specifications by product:

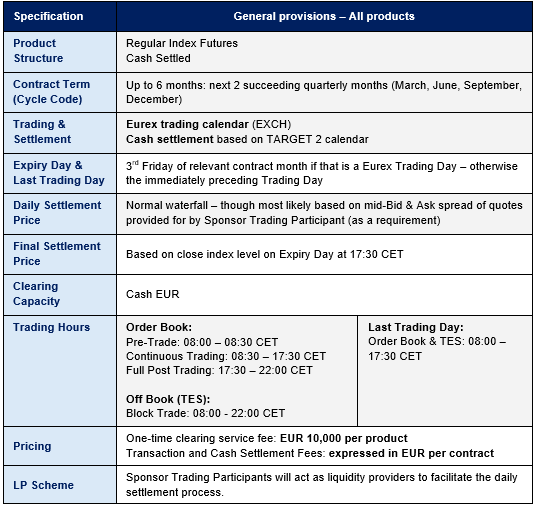

Contract specifications applicable to all products:

C. Detailed contract specifications and product parameters

For the detailed contract specifications, please see Attachments 1 and 2.

The complete version of the updated Contract Specifications can be found on the Eurex website www.eurex.com under the following path:

Rules & Regs > Eurex Rules & Regulations > 03. Contract Specifications

D. Admission to the T7 Entry Services (TES)

The new products will be admitted to the T7 Entry Services (TES). You can find the minimum block trade sizes on product level in the attached Contract Specifications (Attachment 2).

An overview of the Eurex T7 Entry Services available for the products as well as detailed information on single product basis with regard to availability, possibility of utilization and minimum entry size for the Eurex T7 Entry Services is available on the Eurex website under the link:

Data > Trading files > T7 Entry Service parameters

E. Transaction fees

The transaction fees for the new products can be retrieved from the updated sections of the Price List of Eurex Clearing AG, as outlined in Attachment 2 to Eurex Clearing Circular 078/25. The full version of the updated Price List will be published on the Eurex Clearing website www.eurex.com/ec-en/ under the link:

Rules & Regs > Eurex Clearing Rules & Regulations > 3. Price List

F. Vendor codes

At start of trading, vendor codes for the new products will be published on the Eurex website under the link:

Markets > Product Overview > Vendor Codes

G. Risk parameters

As of start of trading, risk parameters of the new products will be published on the Eurex website under the link:

Data > Clearing files > Risk parameters and initial margins

and on the Eurex Clearing website under the following link:

You will also find an updated list with details regarding Prisma-eligible Eurex products under this path.

H. Mistrade parameters

Mistrade ranges and position limits for the new products will be published as of start of trading on the Eurex website under the link:

Attachments:

- 1 – Updated sections of the Contract Specifications for Futures Contracts and Options Contracts at

Eurex Deutschland - 2 – Updated sections of Annex C and new Annex L to the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Contact: | Stuart Heath, Equity & Index Product Design, tel. +44-207-862-72 53, stuart.heath@eurex.com; Elena Marchidann, Equity & Index Product Design, tel. +44-207-862-72 65, elena.marchidann@eurex.com | |

Web: | ||

Authorized by: | Matthias Graulich |