28 May 2025

Eurex

T7 Release 13.1: Activation of Pre-Trade Risk Limits for Options Products

- This circular is only available in English./Dieses Rundschreiben ist nur in Englisch verfügbar. -

1. Introduction

As already mentioned in Eurex Circular 037/25, the following options products will be activated for the on-book Pre-Trade Risk (“PTR”) limit functionality in the Production environment providing the support of the PTR limit functionality for all options and futures products. The list of options products currently not supporting on-book PTR limits comprises all Eurex options products except Single Stock Options and options on currency:

- Options on Fixed Incoming Futures (OFBD)

- Options on Money Market Futures (OFIT)

- Options on Futures on Index (OFIX)

- Options on Index (OINX) excluding OESX / OEXP / OTUK

- OESX / OEXP / OTUK (partition 7 options)

2. Required action

Trading Participants interested in using the PTR limit functionality for options for on-book trading are requested to get familiar with the functionality in the Eurex Simulation environment.

3. Details of the initiative

The launch of T7 Release 13.1 provides the prerequisite to continue the roll-out of the PTR limit functionality to all derivatives products, particularly for options products (see also the Final T7 Release 13.1 Notes on the Eurex website under the following path:

Support > Initiatives & Releases > T7 Release 13.1

The present circular provides details about the activation of the on-book PTR limits to derivative products currently not supporting this functionality.

A. Remaining futures products currently not supporting on-book PTR limits

The list of futures products currently not supporting on-book PTR limits comprises Equity Total Return futures, Index Dividend Futures, Money Market Futures, Single Stock Futures, Single Stock Dividend Futures and Stock Tracking Futures.

Since the beginning of April 2025, all those futures have already been activated for on-book PTR limits in the production and simulation environment.

B. Remaining options products currently not supporting on-book PTR limits

The list of options products currently not supporting on-book PTR limits comprises all Eurex options products except Single Stock Options (OSKT) and Options on Currency (OCUR).

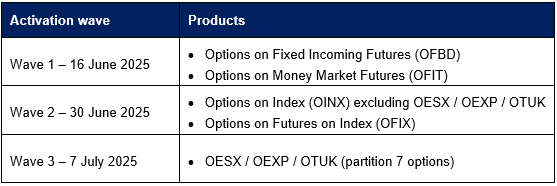

Activation of on-book PTR limits for options products will be performed in three different activation waves:

In the Simulation environment, activation of on-book PTR limits for corresponding options products was already performed during T7 Release 13.1 Member Simulation prior to the production launch of T7 Release 13.1.

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration | |

Related circulars: | ||

Contact: | client.services@eurex.com | |

Web: | Support > Initiatives & Releases > T7 Release 13.1 | |

Authorized by: | Jonas Ullmann |