Release 2.9

With the Member Section Release 2.9, Deutsche Börse introduced new services for Member Section users. To ensure a smooth readiness an overview of release relevant content for Trading and Clearing Members is available on this website.

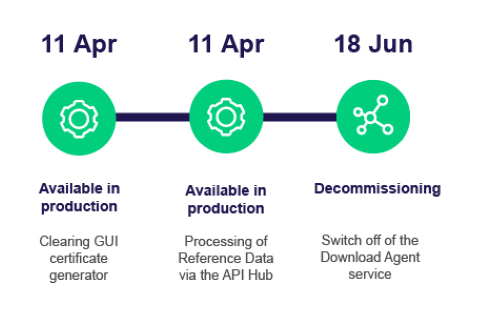

Production start: 11 April 2022

Release Items/ Participants Requirements

Feature/Enhancement | Details | Action Item |

Decommissioning of the Download Agent/Processing of Reference Data (short codes and algoIDs) via API Hub | As of 11 April, the automated upload services "ALGO HFT Upload" for algoIDs and "Client Identification Upload" for short codes will be available via the API Hub. The new solution enables an easy implementation of automatic uploads for clients. The new services will be available in the Member Section via the following path: Technical Connection > API Hub > ALGO HFT Upload / Client Identification Upload. To access the API Hub the permission: Self Service Certificate Admin is required. The API Hub will replace the Download Agent service. After the transition period, the Download Agent will be switched off on 18 June 2022. | Trading Participants using the Download Agent have to migrate their upload processes to the new API Hub in order to ensure the fulfilment of their data provision obligation according to art. §72 Eurex exchange rules. Trading Participants need to get familiar with the API Hub service and request the respective permissions "Self Service Certificate Admin". To use the APIs, please follow the setup process as described in the Technical Connection user guide (chapter 2.5). |

Introduction of the Eurex Clearing GUI certificate generator | A new automated process will be introduced for ordering Eurex Clearing GUI certificates. The new self-service certificate functionality will provide clients the opportunity to directly create and install a certificate for the Eurex Clearing GUI services without the need to wait for a service order process. This is in alignment with the harmonization of the certificate infrastructure. The web-based tool will generate the certificate for clients and can be found under the following path: Technical Connection > Requests and Configuration > Self Service Certificates > Eurex Clearing GUI. To access the new service the permission "Self Service Certificates Admin" is required.

| There is no action required from clients. |

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!

Contact

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex

Member Section

Customer Support

Service times from 09:00 - 18:00 CET

T +49-69-211-1 78 88