Jun 10, 2025

Eurex

Focus on VSTOXX® Derivatives | May 2025 recap

- European markets had a very strong performance, with the EURO STOXX 50® up 4%, STOXX® Europe 600 up 4.02%, and the DAX® up 6.67%.

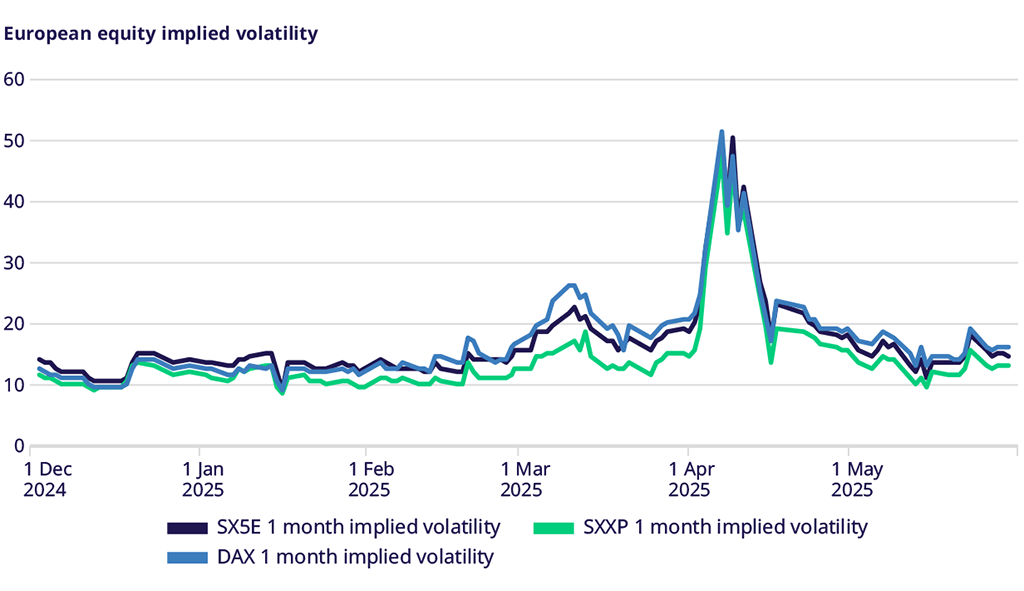

- Despite very strong equity markets, equity implied volatility was roughly flat for the month, given the strength of the moves.

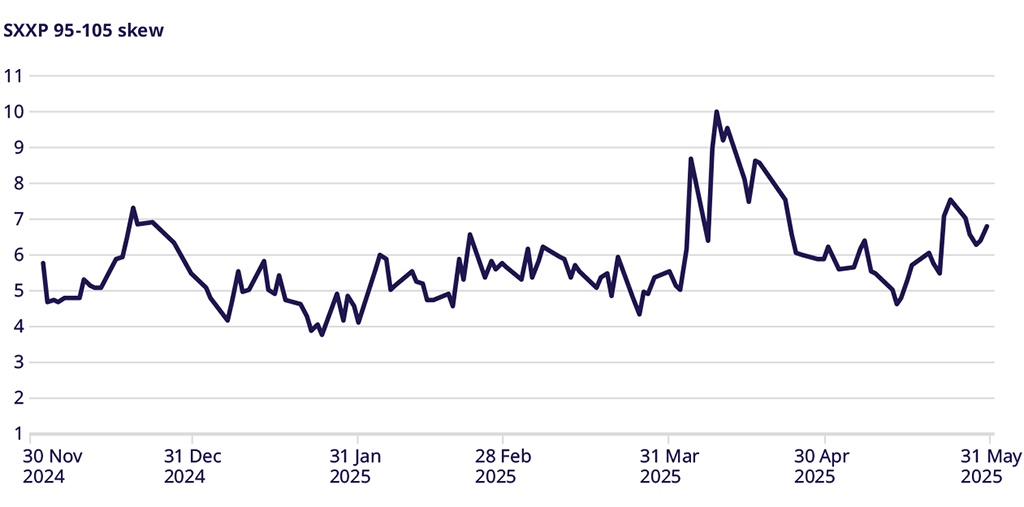

- Skew moved higher in favor of downside puts, seemingly driven by a higher supply of upside options than by demand for downside options.

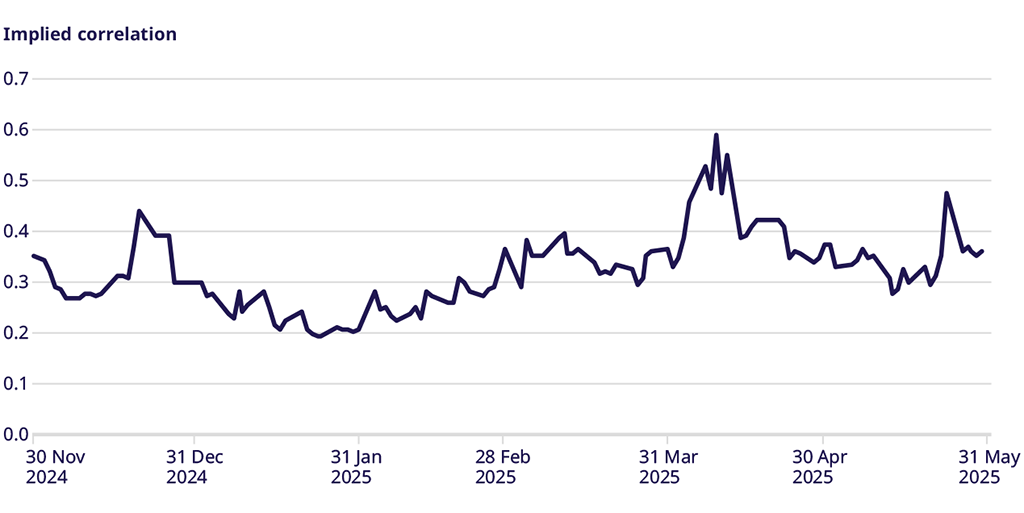

- Implied correlation was constant throughout May, down from the elevated levels of early April but higher than January’s lows.

Equity Index Volatility

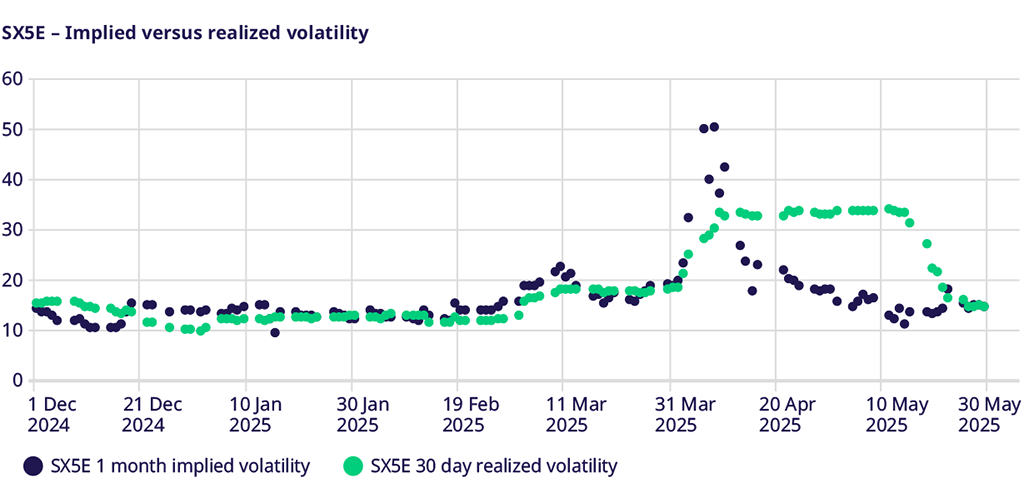

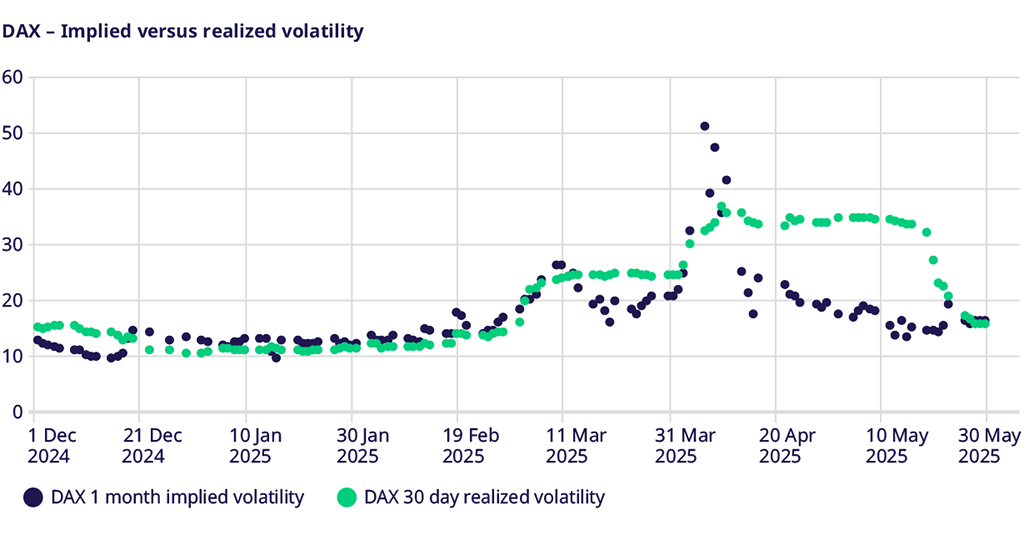

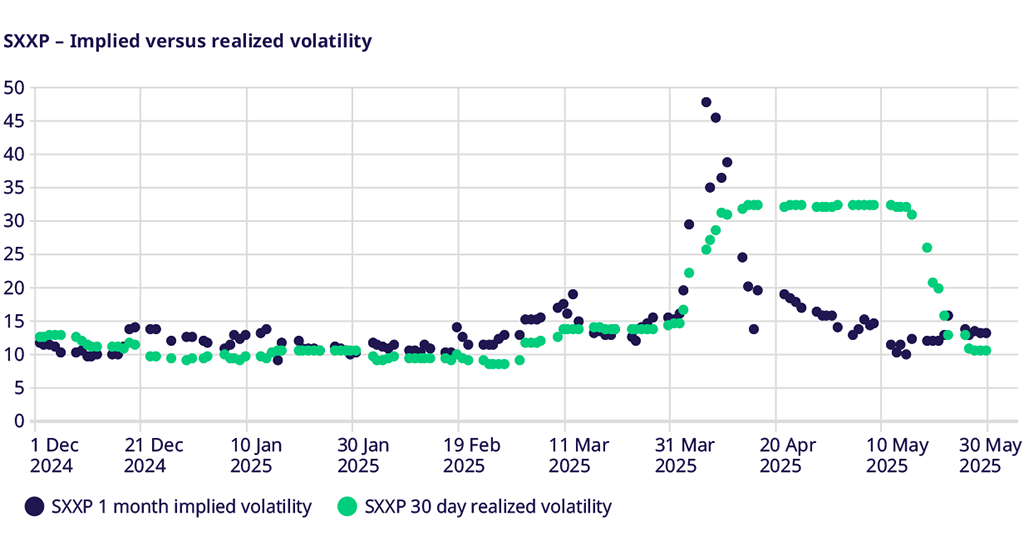

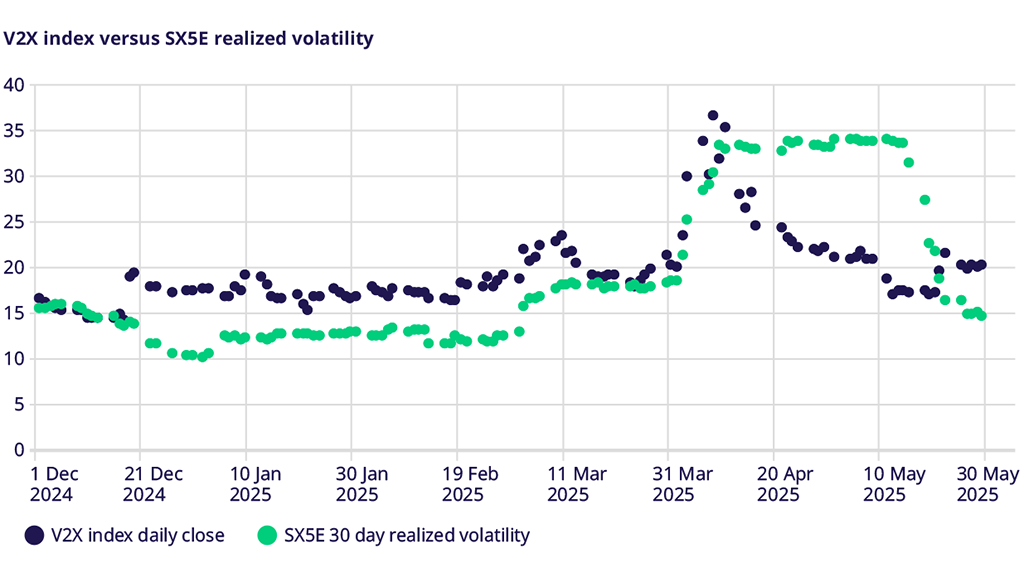

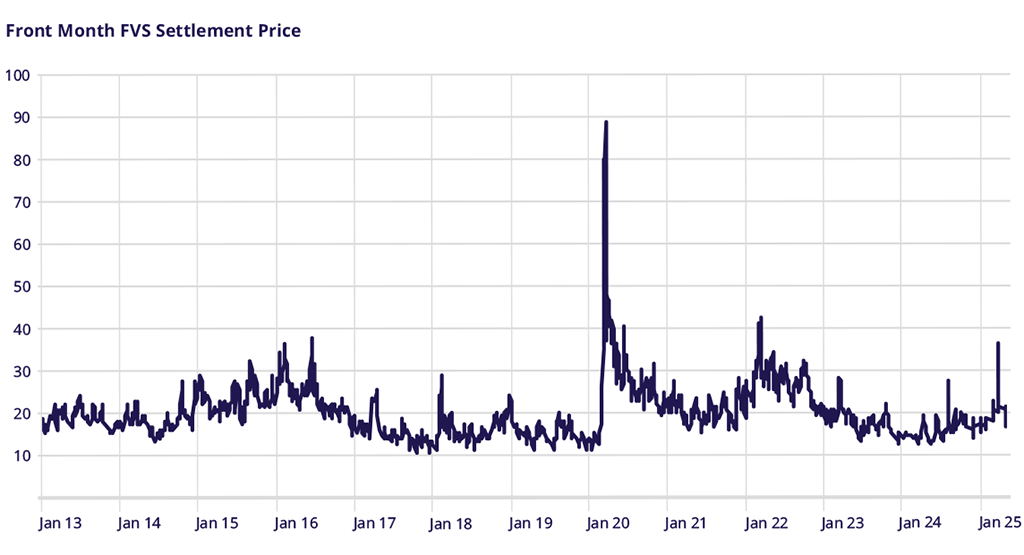

By the end of April, equity implied volatility had already started to decrease, signaling the expected drop in realized volatility as tariff news decreased. May was characterized by relatively flat implied volatility, while elevated realized volatility “caught down” to the levels of implied, resulting in little, if any, spread between implied and realized by the end of May across the market.

VSTOXX Index performance

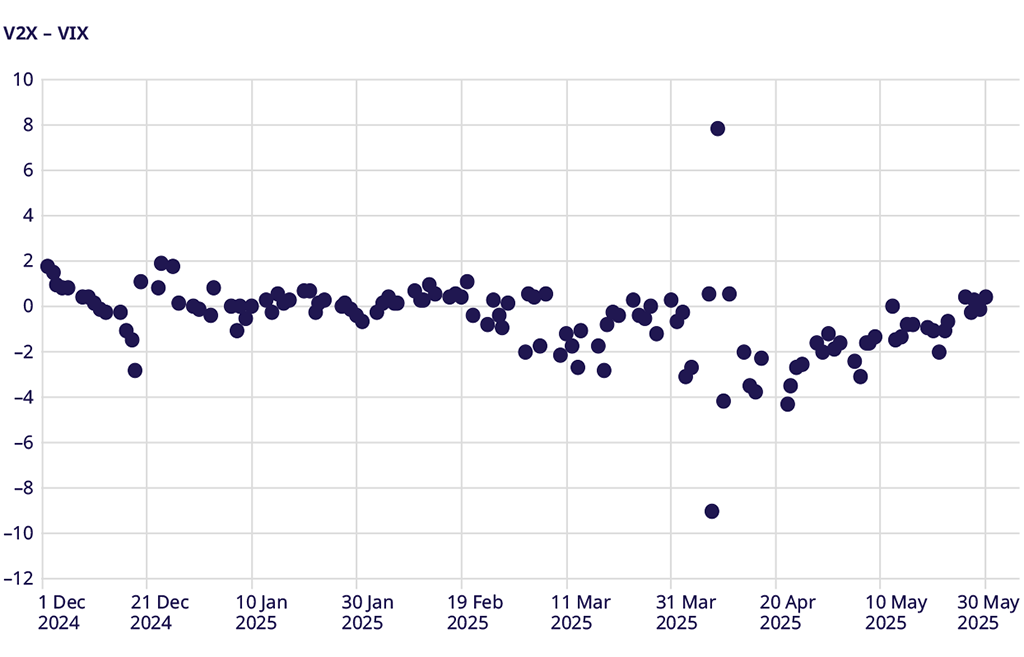

Similarly, V2X fell early in the month as realized volatility also fell. However, it started to inch back by month’s end, finishing flat for the month. The more significant move was in the quieting of the spread between V2X and VIX, as the high premium of VIX over V2X gradually eroded, resulting in zero spread by the end of the month. This could indicate that traders anticipate less macro risk.

STOXX Europe 600 Index Skew

The 95-105 equity skew moved up one vol point over the month, from 6 to 7, in tandem with sharply higher equity index markets. The wider spread was the result of upside implied volatility dropping faster than downside volatility, even though both were lower. This might be because traders were looking to unwind hedges and overwrite positions with summer approaching and tariff news slowing.

Correlation

The implied correlation was only slightly higher for the month despite a late-month spike around the introduction and subsequent postponement of U.S. tariffs on the EU. However, implied correlation levels are still near long-run norms.

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

VSTOXX 101: Understanding Europe’s Volatility Benchmark

Discover the latest STOXX whitepaper today to learn more about the VSTOXX® core methodology, historical performance analysis, and more.

For more information, please visit the website or contact: