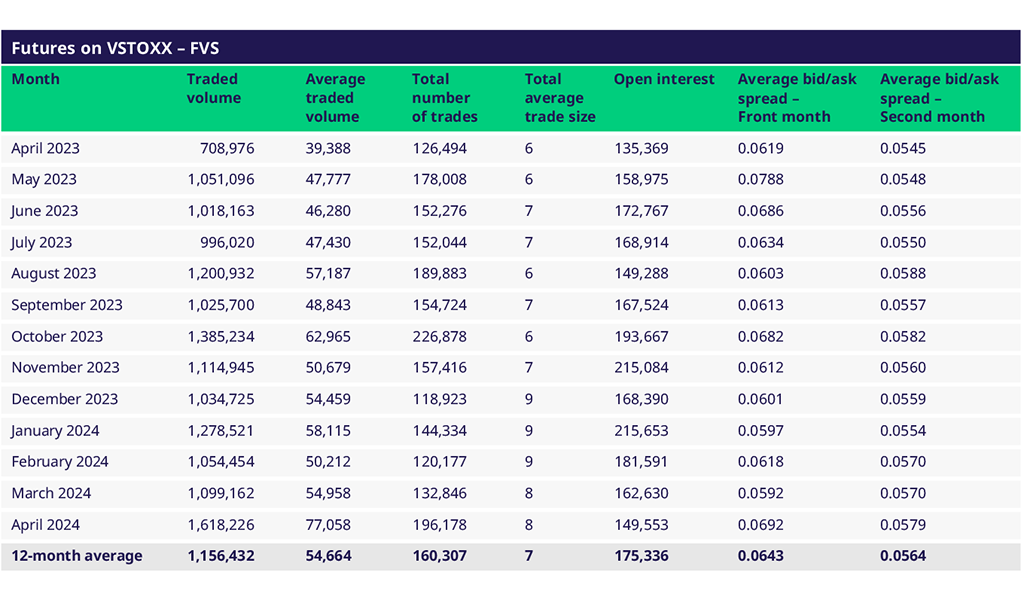

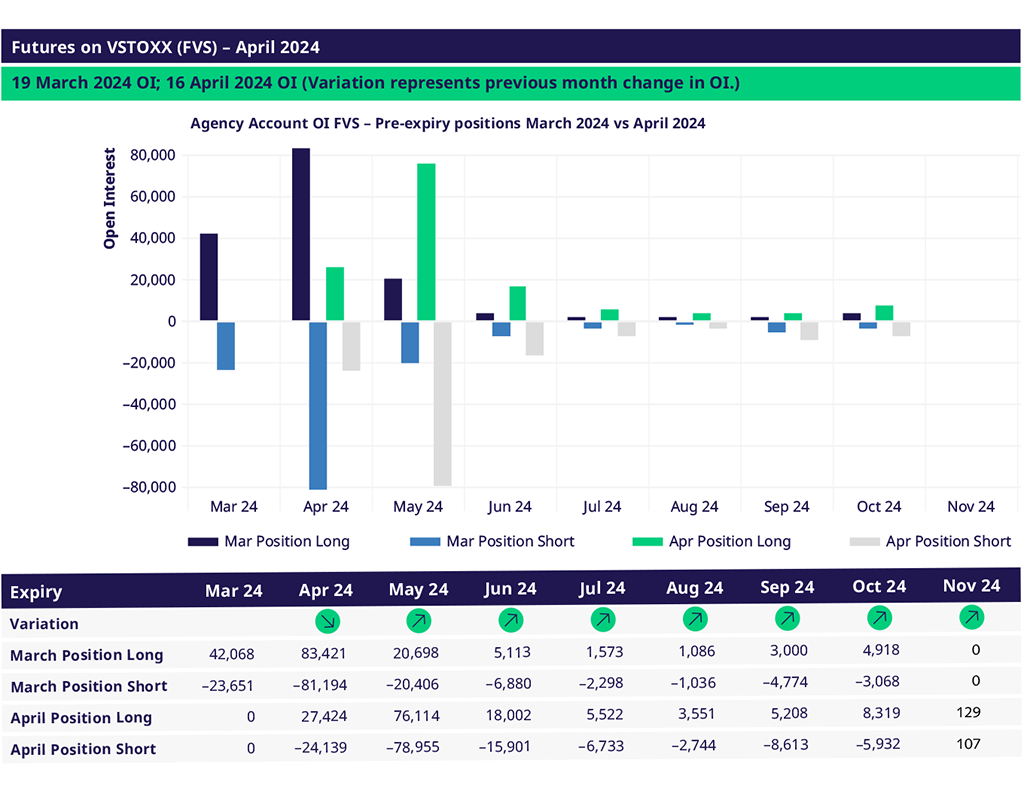

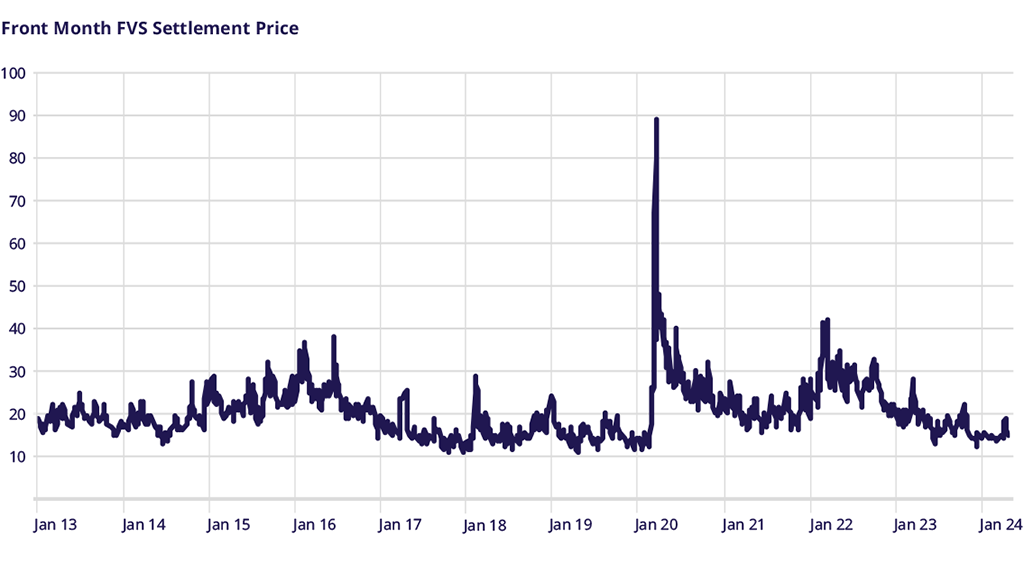

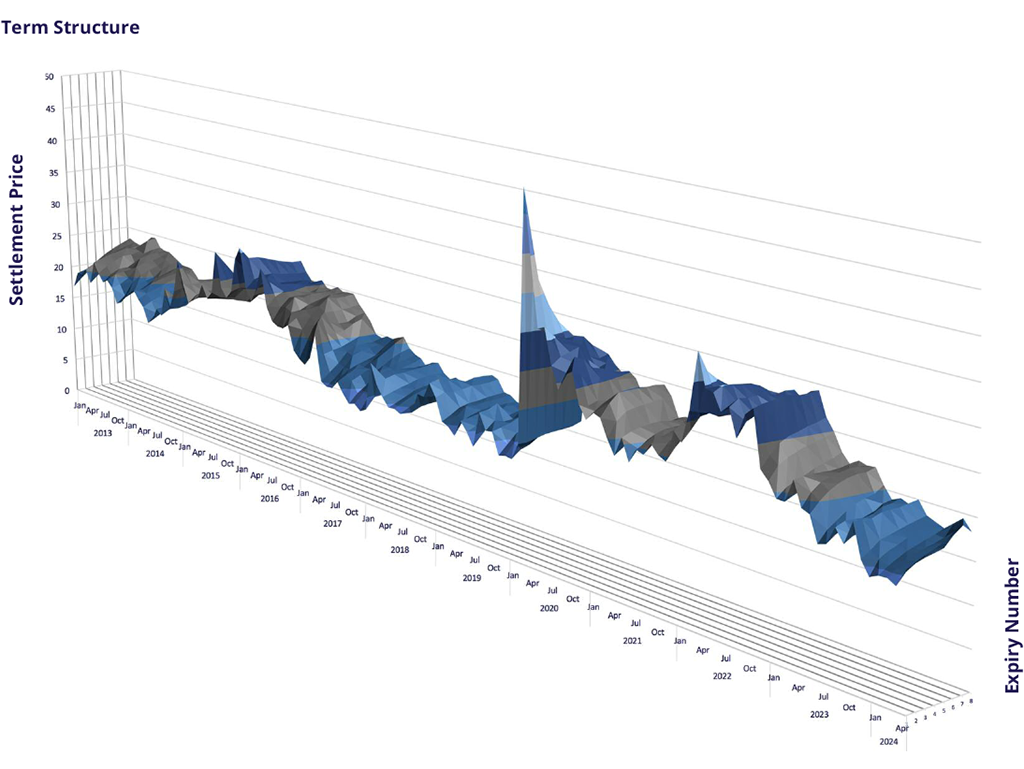

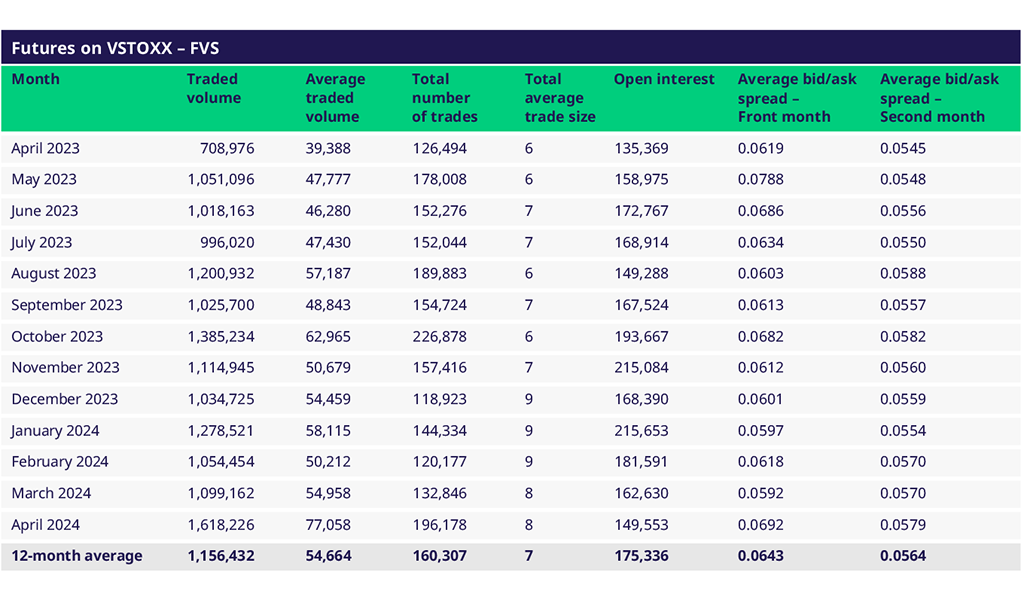

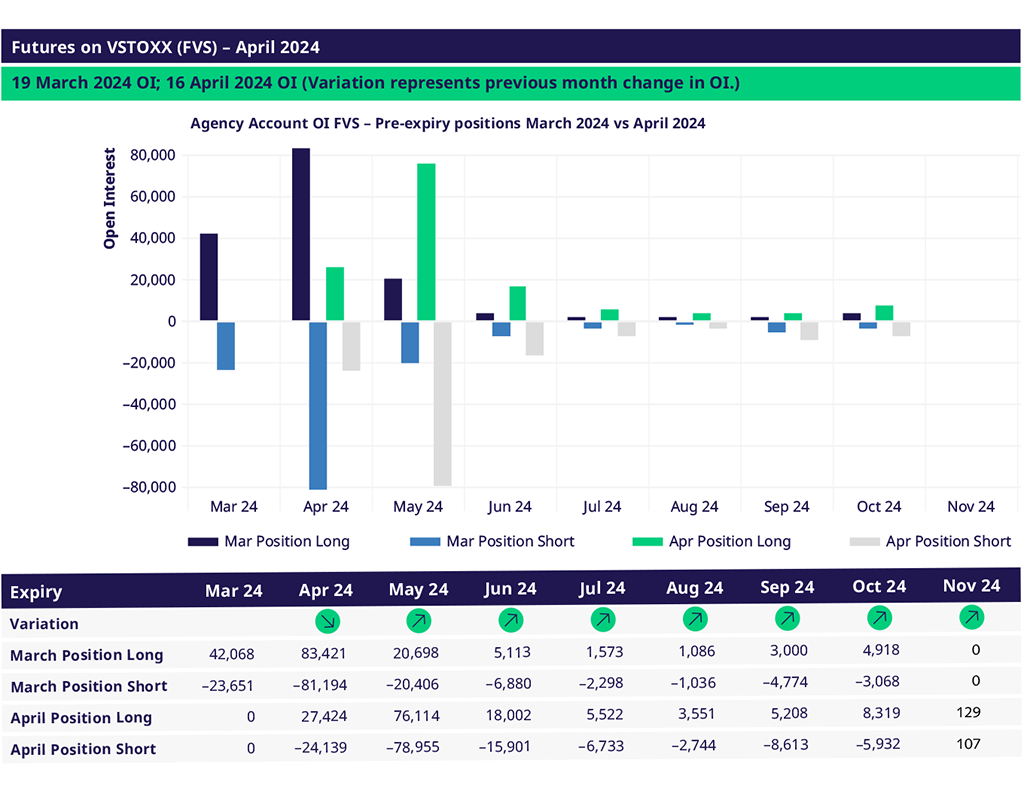

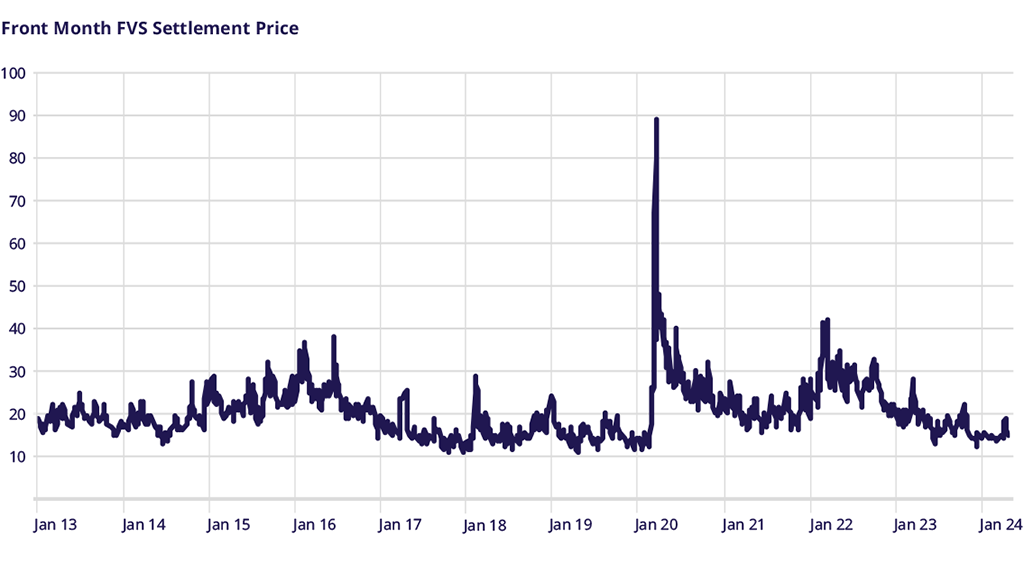

The resurgence of volatility in April took VSTOXX on a near roundtrip run from sub-14 to over 20. The VSTOXX Futures had their heaviest trading month since January 2022, with over 1.6 million contracts trading. Futures ADV jumped considerably to 77k contracts in April, up 50% from the trailing 12-month average. The bid/ask for both the front and second-month contracts stayed remarkably tight, only barely slipping above the 12-month average spread. The most active days of the month were 12 April (162k contracts) and 16 April (130k contracts). Notably, these were also the busiest individual days since the March 2023 banking crisis.

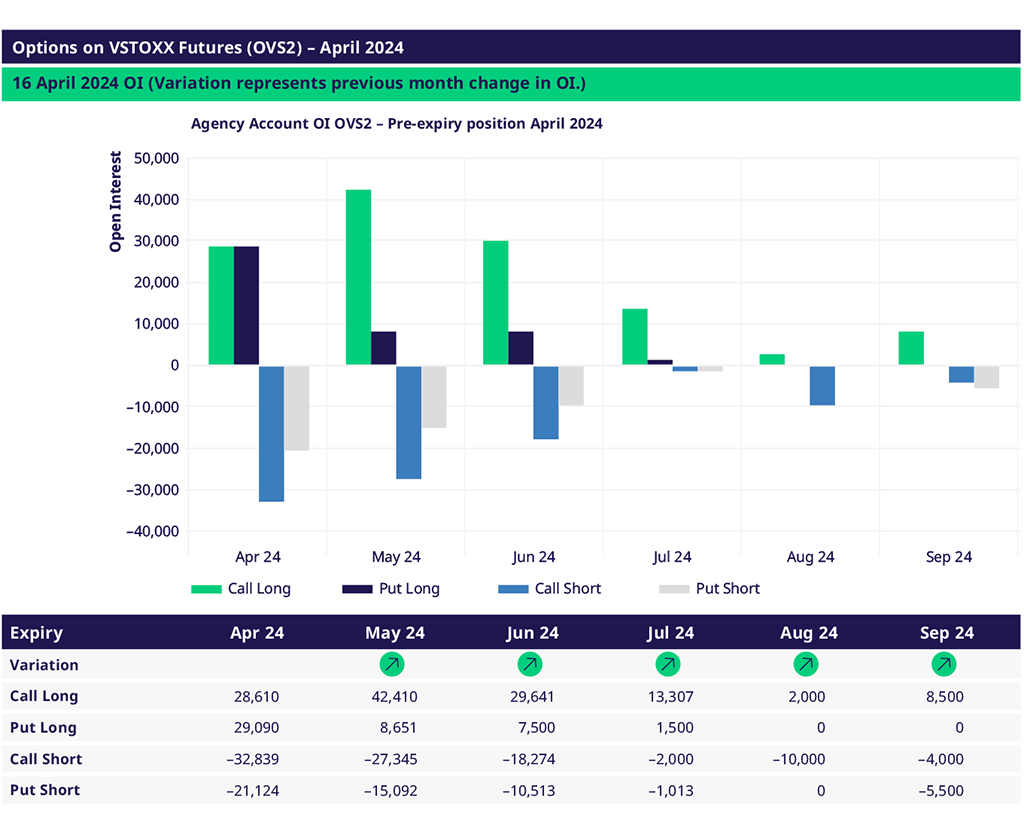

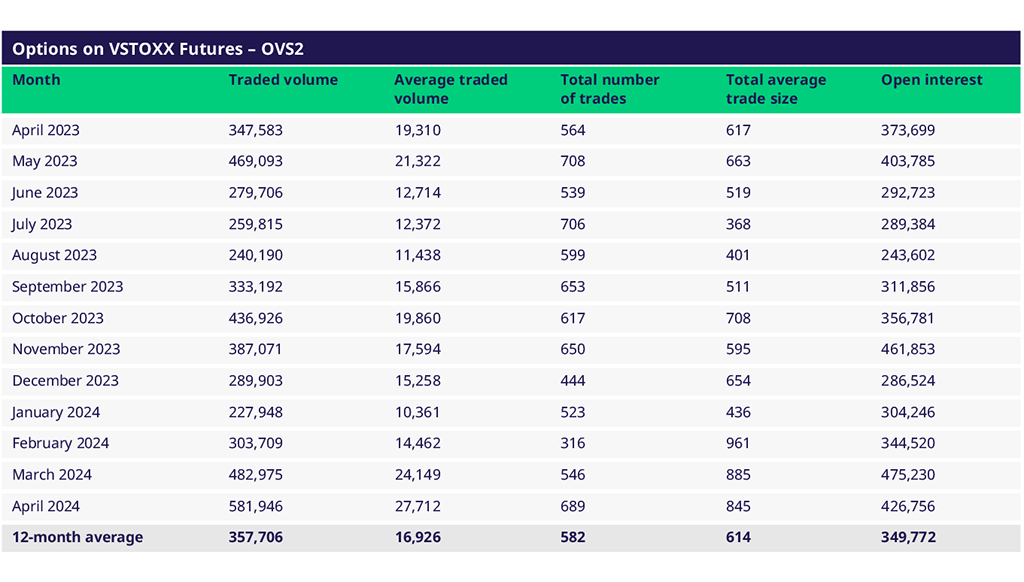

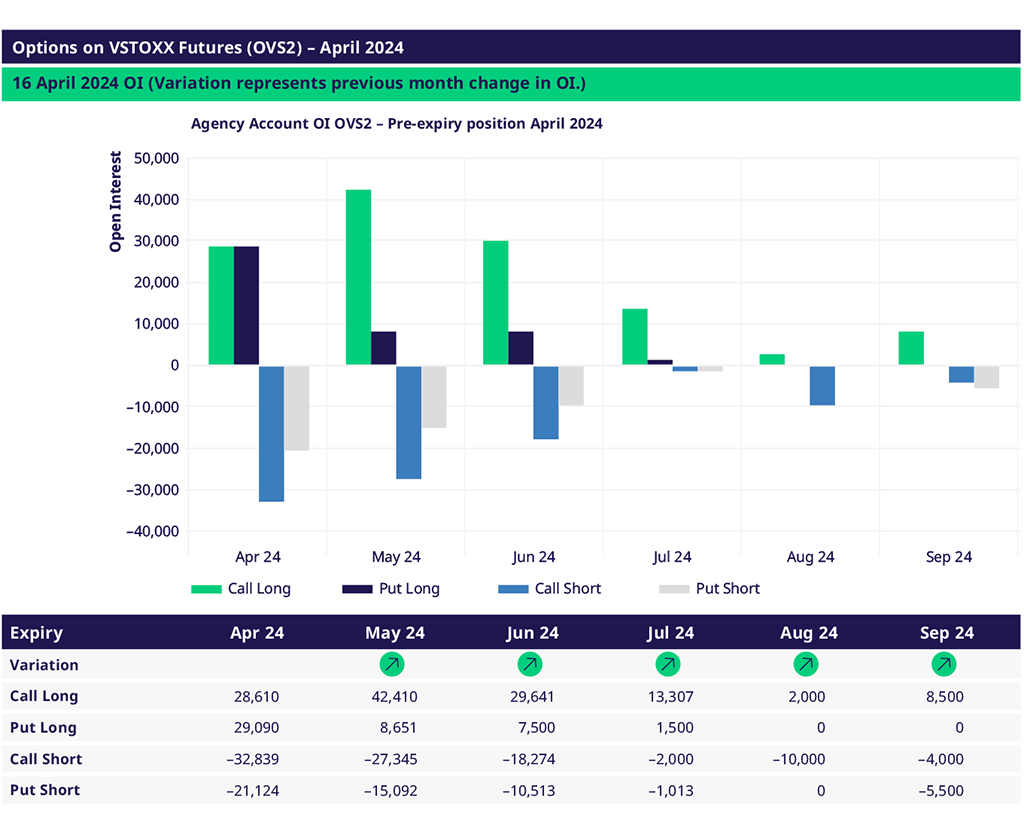

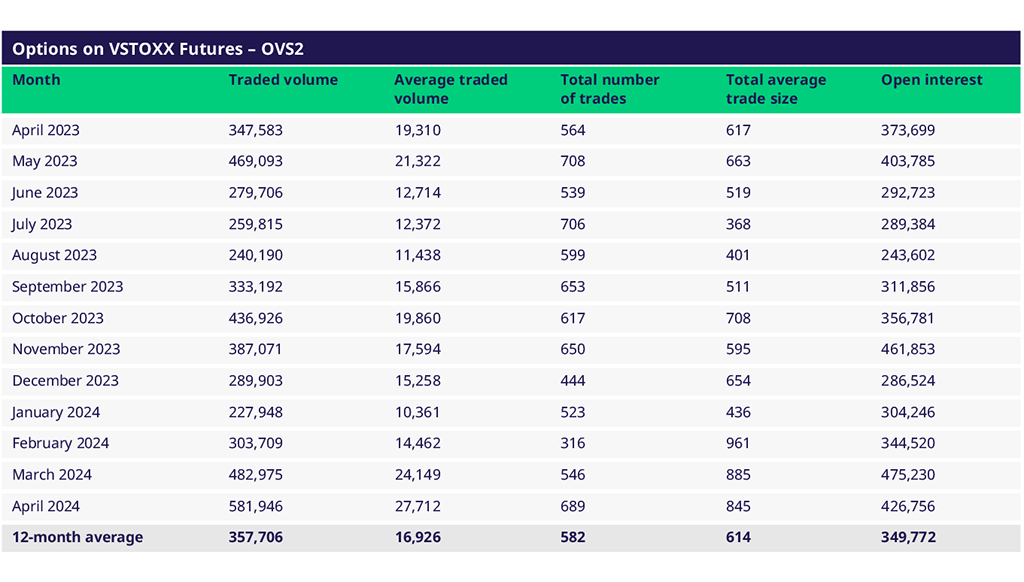

The Options on VSTOXX Futures also had their most active month since the 2023 banking crisis, with 581,946 options trading. ADV was 71% above the trailing 12-month ADV. 10 April was the busiest day of the month, with over 54k contracts trading. Pre-April expiry agency account positioning can be found below.

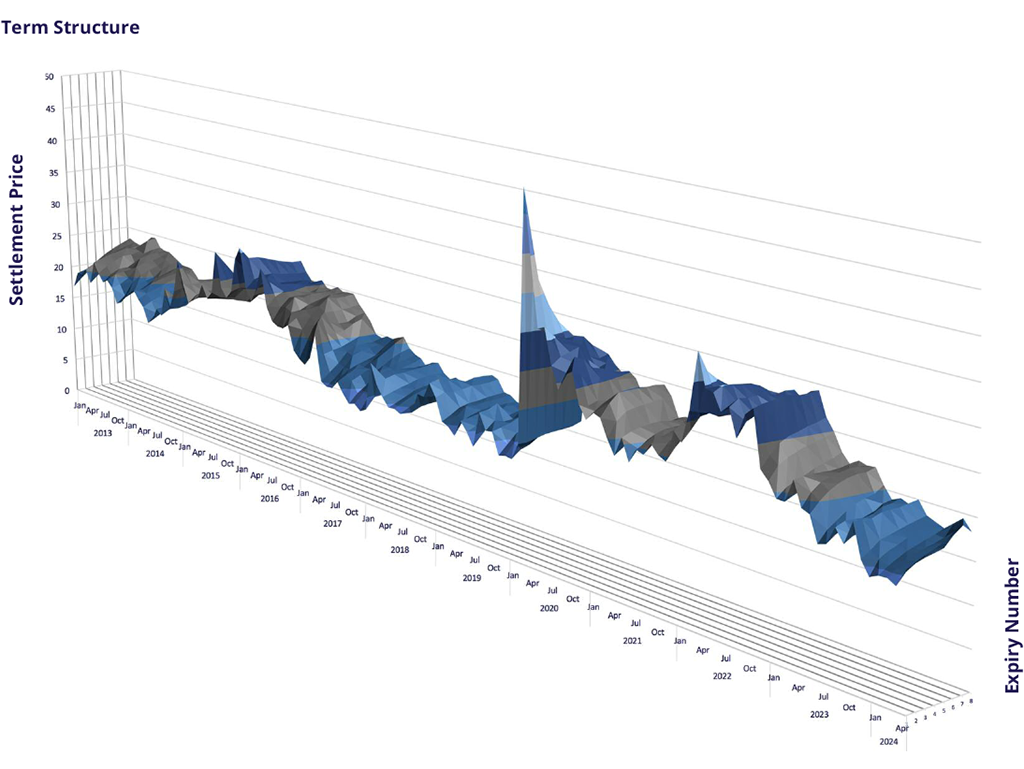

VSTOXX Futures (FVS)

Options on VSTOXX Futures (OVS)

For more information, please visit the website or contact: