Aug 12, 2025

Eurex

Eurex Repo Monthly News July 2025

Market briefing: ''Steady growth in GC Pooling amid mixed Repo dynamics''

by Frank Gast and Carsten Hiller, Eurex Repo

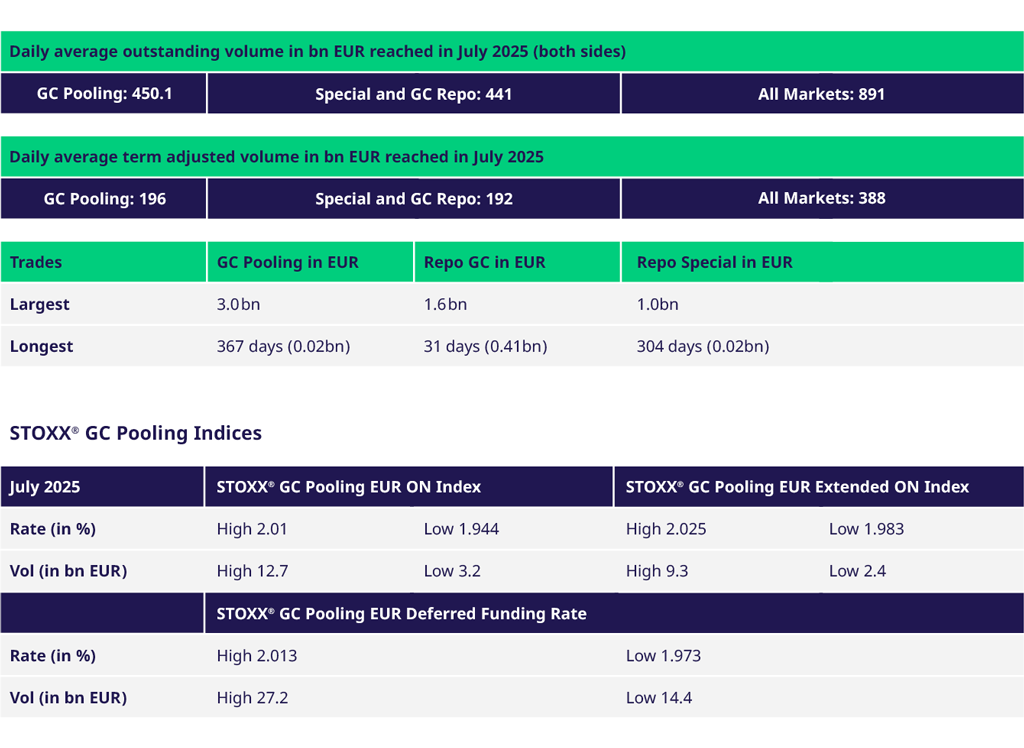

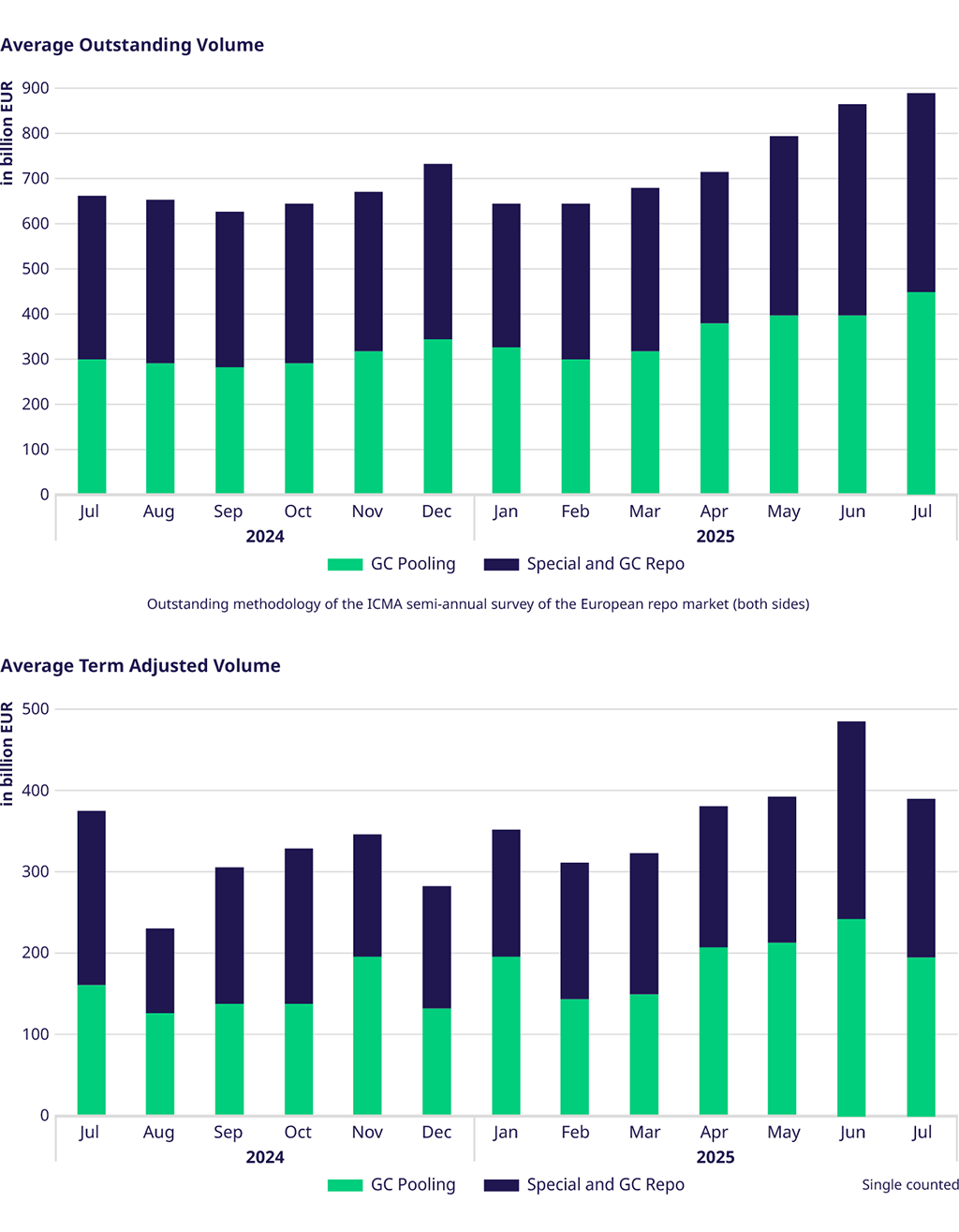

In July 2025, Eurex Repo observed a continued upward trend in GC Pooling activity, which helped offset a decline in the Repo segment. Compared to July 2024, average term-adjusted volumes increased by 4 percent overall. This growth was driven by a 19 percent rise in GC Pooling volumes, while Repo volumes declined by 9 percent. On a year-to-date basis from January to July, term-adjusted volumes rose by 3 percent compared to the same period in 2024. GC Pooling contributed significantly with a 21 percent increase, whereas Repo volumes fell by 12 percent.

Outstanding and Traded Volumes

Outstanding volumes reached a new record high on 28 July 2025. When compared to July 2024, average outstanding volumes increased by 34 percent overall. GC Pooling volumes rose by 51 percent, and Repo volumes grew by 20 percent. Traded volumes also showed a modest increase, with a 2 percent rise overall. GC Pooling traded volumes were up by 8 percent, while Repo traded volumes declined by 5 percent.

Spreads and Collateral

Spreads between baskets and benchmark rates remained relatively stable throughout the month. The overnight spread between the ECB and EXT basket widened slightly, moving from an average of 1.3 basis points to 1.6 basis points. The spread between the ECB basket and the deposit facility rate (DFR) remained largely unchanged at –0.7 basis points. Meanwhile, the spread between the EXT basket and the DFR increased slightly to nearly 1 basis point.

GC & Specials

In the Special Repo segment, Bund volumes declined by 6 percent year-on-year for the period January to July, compared to 2024. This decrease was mainly due to reduced selling activity of GC Bunds.

On the other hand, the positive development in SSAs, particularly in EU bonds, continued. Traded volumes in EU bonds increased by 13 percent in July, reaching the second-highest level recorded so far.

There was also notable term business in single ISINs within the Special Repo segment, especially in Italian government bonds. These transactions were executed in non-standard terms of three months, with large trades extending until January 2026. Additionally, some covered bonds saw good volume in term transactions until January 2026.

GC Pooling

GC Pooling activity in July was characterized by less term business in standard maturities. Most transactions were concentrated in terms up to two months within the ECB and EXT baskets. However, there were also some flexible and non-standard term transactions extending to five and ten months in the ECB basket. A particularly noteworthy transaction was a two-year deal in the EXT basket, executed with quarterly breaks.

Furthermore, the INT MXQ basket experienced increased business in one-, two-, and three-month terms.

Volumes

| |||

|

Participants: 165