May 12, 2025

Eurex

STOXX Europe TM Defense Futures: The strategic instrument for the defense sector

Over the past three years, defense has returned to the forefront of political and public discussion in Europe. Geopolitical events continue to drive an increase in defense spending. Emerging challenges and the need for modernization contribute to a strong demand for defense products and services. Defense spending is expected to remain significant, with European countries investing in national security and military capabilities to meet the challenges. Also, the European Commission has taken steps to promote Europe’s defense industrial capacity and resilience through initiatives such as the European Defense Fund.

This renewed focus on defense by policymakers drives significant increases in planned spending. As a result, defense stocks have outperformed broader industrial benchmarks in recent years, and sector ETFs, along with thematic funds, have experienced steady inflows. However, many investors targeting the sector find themselves constrained by legacy indexes that offer broader coverage, often including civil aerospace, dual-use manufacturers, and conglomerates with limited exposure to defense.

The new STOXX® Europe TM Defense Futures are designed to fill this gap.

Eurex will launch the STOXX® Europe TM Defense Futures on 12 May 2025, offering targeted access to companies that derive a material share of their revenues from defense-related activities.

Focused exposures

The new futures contract is based on the STOXX® Europe Total Market Defense Capped Index, developed to offer focused exposure to European defense stocks. The index comprises European companies that have demonstrated a proven revenue exposure to defense activities based on verified industry classifications and public disclosures.

The index comprises 21 aerospace and defense firms, including Rheinmetall, Leonardo, Thales, BAE Systems, and Rolls-Royce Holdings. The index applies a 10 percent cap on individual constituents at each quarterly review to prevent overconcentration in a handful of large-cap names. This makes the index more balanced while still retaining high fidelity in the defense sector. The methodology focuses on revenue-derived classification using Revere (RBICS) data rather than just sector labels, ensuring a genuine representation of defense activity.

The STOXX® Europe TM Defense Capped Index, which underlies the futures, differs from the more general STOXX® Europe Total Market Aerospace & Defense Index. While the broader index includes aerospace and dual-use manufacturers, including those whose primary revenues may come from civilian aircraft, space systems, or industrial technologies, the capped index narrows its focus to firms with a more concentrated defense business model. This distinction is important to asset managers and sector allocators aiming to isolate thematic exposure without excess tracking error or overlap with non-defense industrials.

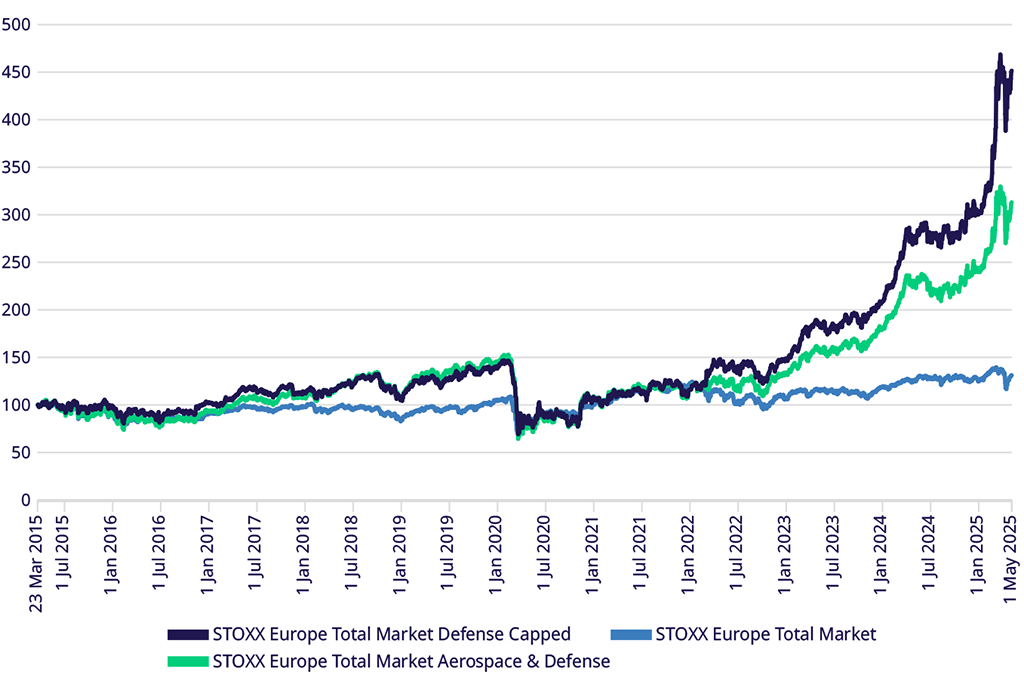

STOXX® reports that the index has delivered a return of 239 percent over the past three years and 52 percent in 2025. In comparison, the STOXX® Europe Total Market Aerospace & Defense index, which includes the sectors of design, development, production, and commercial aircraft maintenance, has returned 165 percent and 35 percent, respectively.

Index Performance Chart

Source: STOXX. Price version in euros through 1 May 2025. Indices normalized at 100 on 23 March 2015.

Built for institutional use

The STOXX® Europe TM Defense Futures are structured to meet the needs of institutional investors and active traders alike. Each contract is valued at EUR 50 per index point, with a minimum tick size of 0.1 index points — equivalent to EUR 5 per tick. Contracts are cash-settled, using the average index level recorded between 11:50 and 12:00 CET on the final trading day, which falls on the third Friday of each maturity month in the standard March, June, September and December quarterly cycle.

To support the efficient execution of block trades, the minimum size for block trades via TES or EnLight is set at 50 contracts. Trading will be available from 07:50 to 22:00 CET across the order book and off-book channels.

The launch will be supported by Liquidity Providers offering on-screen prices to establish liquidity for this new future contract.

The introduction of STOXX® Europe TM Defense Futures offers a capital-efficient solution for investors looking to manage exposure to the defense sector, whether as part of a thematic allocation or a more tactical trading strategy.

Thematic investors can use the futures to gain targeted exposure to companies positioned to benefit from increased defense spending and strategic shifts within the European political landscape.

Portfolio managers can use the instrument to hedge concentrated equity exposure or implement sector rotations efficiently and quickly. For macro and sector traders, the futures open up tactical positioning opportunities around earnings releases, policy announcements, or geopolitical events. The futures are euro-denominated, removing FX risk for euro-based investors.

Strategic Launch

The STOXX® Europe TM Defense Futures arrive at a time when Europe is recalibrating its strategic and economic posture, with defense playing an increasingly central role in fiscal planning and industrial policy. The sector represents an opportunity for investors to focus on this key international trend and achieve returns uncorrelated to the broader existing indexes.

By introducing precise, transparent, and tradable futures referencing the new index, Eurex enables market participants to engage efficiently and more directly with the European defense sector. Whether as a hedge, tactical tool, or strategic allocation, the new futures contract adds flexibility to the European derivatives toolkit as Europe strengthens its economic and military security in a changing world.